[20 November 2025]. Hong Kong is entering a new era in student accommodation, as highlighted in the latest “Student Living Revisited – Maturing Investment Landscape and Market Execution” report.

With five universities ranked among Asia’s top 20 in 2025, the city continues to strengthen its position as a leading international education hub. This reputation, supported by robust government and university initiatives, is driving a surge in demand for quality student housing and attracting significant investment activity in education-related assets.

Policy Support and Market Response

To further elevate Hong Kong’s global education standing, the University Grants Committee (UGC) has allocated HK$40 million to eight publicly funded universities for enhanced international promotion. The Immigration Arrangements for Non-local Graduates (IANG) policyalso enables international students to remain in Hong Kong after graduation, reinforcing the city’s appeal for global talent and long-term career development.

The 2025 Policy Address will raise the enrolment cap for self-financing non-local students in taught undergraduate programmes from 40% of local student places to 50%, and the over-enrolment ceiling for self-financing places of funded research postgraduates will increase from 100% to 120% from 2026/27. Currently, self-financing non-local postgraduates are the main driver of student accommodation demand, with enrolment up 26% year-on-year (+11,774 students in 2024/25), compared to a 16% rise for UGC-funded non-local undergraduates.

In July 2025, the “Hostels in the City Scheme” was introduced, encouraging private sector participation in converting existing commercial buildings into student accommodations. This initiative has spurred increased interest from joint ventures and investors, who see substantial returns in this emerging sector.

Current Status of Student Accommodation

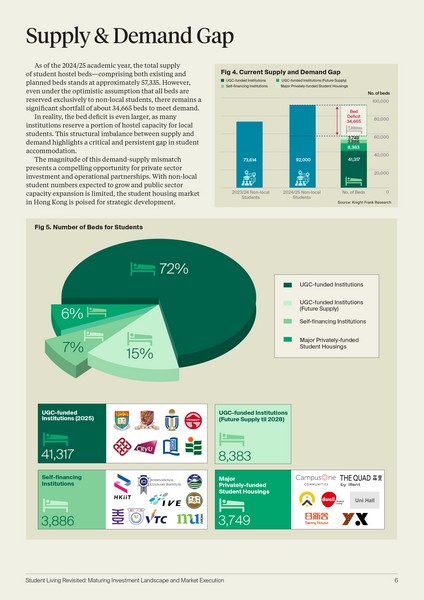

Supply and Demand: The Ongoing Gap

Despite diverse accommodation options—including on-campus halls, purpose-built student accommodation (PBSA), and private rentals—Hong Kong faces a persistent shortage of student beds. As of the 2024/25 academic year, comprising both existing and planned beds stands at approximately 57,335 beds, but the demand from non-local students alone leaves a shortfall of about 34,665 beds. This gap presents a compelling opportunity for private sector investment and operational partnerships. We expect that the student bed shortfall will further expand with strong growth in non-local students and a limited supply pipeline.

The “Hostels in the City Scheme”: Streamlining Growth

The new scheme, effective since September 2025, streamlines planning and building approvals for converting commercial buildings, including hotels, into student hostels. Key features include:

- Expanded definition of “hotel” use to include eligible student hostels

- No planning approval required for most commercial sites

- Relaxed building regulations and plot ratio requirements

- Allowance for partial conversions

- Conversion works should be completed within 18 months

While the scheme fosters efficient repurposing of underutilised buildings, challenges remain, such as conversion costs and timelines. Nevertheless, converting hotels remains the most effective solution, by retaining the hotel license and conducting minimal refurbishments.

Investment Momentum and Case Studies

The trend of converting hotels into student accommodation is accelerating. Year-to-date, investment consideration for potential student accommodation supply reached HK$3.3 billion in 2025, a 2.5-fold increase from 2024.

Notable transactions include the transformation of Popway Hotel into One Pace 117, which achieved 98% occupancy within two months of opening and offers 121 beds across various room types. Monthly rents range from HK$6,355 for bunk-bed trio rooms to HK$19,530 for deluxe single rooms with sea views.

Benefits for Investors

Student accommodation in Hong Kong offers:

- Stable returns: Year-long leases and advance payments provide consistent income and strong liquidity. Student accommodation provides higher market yields (4.5% to 5%) compared to traditional Grade-A office (3.7%) and small to mid-sized residential sectors (3.2% and 3.6%).

- High occupancy: Students typically require housing for the full academic year, so operators benefit from predictable cash flows and low vacancies. For instance, Sunny House and One Pace 117 achieved 99% and 98% occupancy rates in their early stage of operation and pre-leasing phase, respectively.

- Lower operating costs: Focusing on essential amenities and self-service options reduces overheads. The emphasis on self-service options—such as communal kitchens and laundry facilities—reduces the need for personnel in housekeeping and maintenance and cuts labour costs significantly.

Recommendations and conclusions:

From left to right – Antonio Wu, Head of Capital Markets, Greater China and Martin Wong, Senior Director and Head of Research & Consultancy, Greater China.

Antonio Wu, Head of Capital Markets, Greater China, commented,“As investor interest in Hong Kong’s student accommodation sector continues to grow, some investors may be concerned about the best exit strategies to maximise their returns. We recommend considering a flexible approach—whether through long-term ownership, institutional investment, direct sales or leases to universities, or public market access via REITs. The “Hostels in the City Scheme” is expected to further streamline the development of privately funded student housing, addressing the acute supply-demand imbalance.”

Martin Wong, Senior Director and Head of Research & Consultancy, Greater China added, “Hong Kong’s student accommodation market is set for substantial growth, driven by rising international student demand and limited supply. Strategic investment—supported by innovative conversions, partnerships, and favourable policies—offers stable returns and diverse exit options. Investors who adapt proactively are well-positioned to benefit from sustained demand and market expansion.”