CBRE’s latest Asia Pacific Hotels & Hospitality Performance & Outlook report explores the key trends driving hotel performance in Asia Pacific, as well as the outlook for the sector.

CBRE APAC Hotels Trends & Outlook 2025

Despite tourism demand and hotel performance in Asia Pacific beginning to stabilise, pockets of growth still remain in the hospitality sector as the region positions itself as the global tourism hub of the future.

Key highlights include:

CBRE APAC Hotels Trends & Outlook 2025

Tourism Growth

- Tourism is growing in Asia Pacific, with travellers increasingly influenced by macroeconomic and social media trends. Recognising emerging travel trends and impacts, including changes in foreign exchange rates and travel planning via social media, will be critical in capturing future tourism demand.

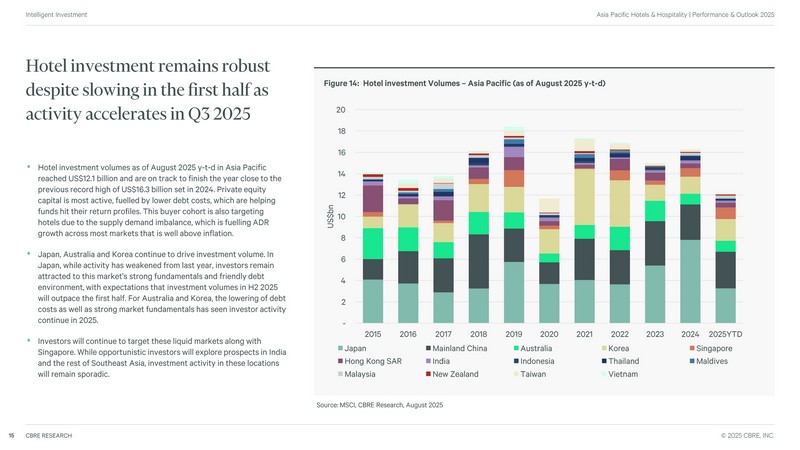

Investment

CBRE APAC Hotels Trends & Outlook 2025

- Robust hotel investment in Asia Pacific, with liquid markets such as Japan, Korea, Australia and Singapore the most popular.

- Hotel investment volumes as of August 2025 y-t-d in Asia Pacific reached US$12.1 billion and are on track to finish the year close to the previous record high of US$16.3 billion set in 2024. Japan, Australia, and Korea continue to drive investment volume.

- Investment in co-living is accelerating in many markets, particularly in Korea, Singapore, Australia, and Hong Kong SAR, as investors look to offer flexible living solutions in tight residential markets.

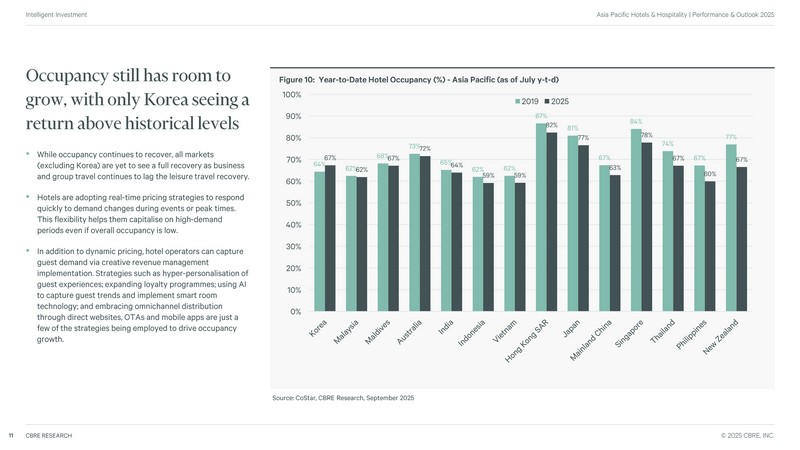

Performance

CBRE APAC Hotels Trends & Outlook 2025

- Hotel performance continues to improve, but hoteliers need to be more creative through revenue management strategies such as demand-based pricing, hyper-personalisation and growth of loyalty programmes.

- Supply to remain constrained as construction costs impact development. However, conversion or rebranding will continue to offer opportunities.