(9 April 2024, Hong Kong) Hong Kong’s economy is limping along with challenges such as elevated interest rates, weak investment sentiment, and suboptimal levels of inbound tourism. Yet, the commercial real estate market in Q1 2024 exhibited resilience with divergent trends across sectors, according to CBRE Hong Kong’s 2024 Q1 Market Review.

“During the quarter, the office leasing momentum improved both quarter-on-quarter and year-on-year, however, vacancy edged up further as new supply enters the market; retail leasing velocity softened primarily due to reduced vacancy with all submarkets back to single-digit levels; slow recovery of the Chinese economy and trade conflicts between major countries continued to pose challenges to industrial leasing; negative carry and uncertainty in leasing demand recovery ensured the investment market sentiment stayed weak. As inbound tourism and overall economic momentum continue to recover, and the government removed all property curbs, we foresee that property demand will continue to improve in the remainder of the year,” said Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong.

• Marcos Chan, Executive Director and Head of Research, CBRE Hong Kong

• Samuel Lai, Executive Director, Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong

• Ada Fung, Executive Director, Head of Advisory & Transaction Services, CBRE Hong Kong

• Reeves Yan, Executive Director, Head of Capital Markets, CBRE Hong Kong

• Lawrence Wan, Senior Director, Advisory & Transaction Services – Retail, CBRE Hong Kong

Review and Commentaries

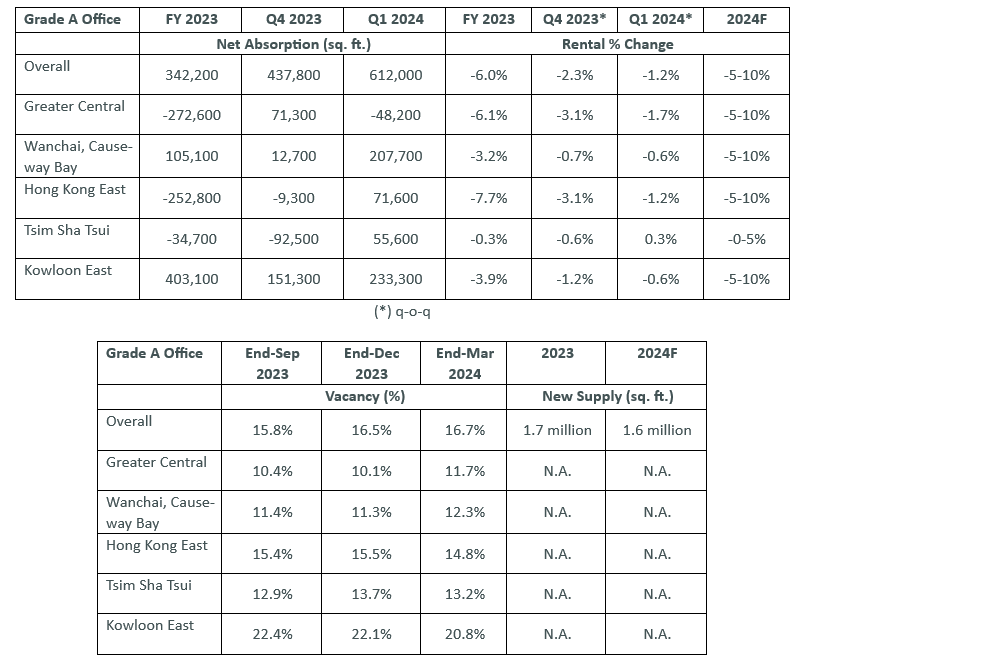

Grade A Office

- Office leasing volume increased by 35% quarter-on-quarter 1.3 million sq. ft. in Q1 2024, partly driven by relocation and consolidation demand in recently completed buildings. Over 75% of deals registered this quarter were for space under 5,000 sq. ft.

- Net absorption totalled 612,000 sq. ft., with 400,000 sq. ft. of this figure involving pre-leased space in three newly completed buildings. This quarter’s net absorption was the highest since Q3 2018, when the fully-preleased One Taikoo Place was completed.

- Most submarkets except Greater Central reported positive net absorption. Occupancy in Hong Kong East increased by 71,600 sq. ft., the first growth since Q4 2022, driven by tenants relocating within the same district and taking more space. A few sizable deals in AIRSIDE ensured Kowloon East registered 233,300 sq. ft. of net absorption.

- New supply totalling 925,200 sq. ft. and slow pre-leasing progress in new projects ensured overall vacancy reached another all-time high of 14.7 million sq. ft. or 16.7%.

- The vacancy overhang meant rents fell 1.2% quarter-on-quarter, marking the 20th consecutive quarterly decline.

Ada Fung, Executive Director, Head of Advisory & Transaction Services, CBRE Hong Kong: “For Q1 2024, new leasing activity has improved quarter-on-quarter with close to one-third of activity contributed by the banking and finance sector. Larger transactions involved various quasi-government authorities. New supply in the market has pushed both net absorption and vacancy further to higher levels, and also offers more new options for occupiers. Decentralised locations such as Kai Tak continued to attract occupiers’ attention. Moving forward, with companies’ cost control policies still in effect and further new office supply from the pipeline, vacancy is expected to trend higher and ensure pressure on rents for the rest of the year. We expect the office leasing market will continue to favour occupiers in the short run.”

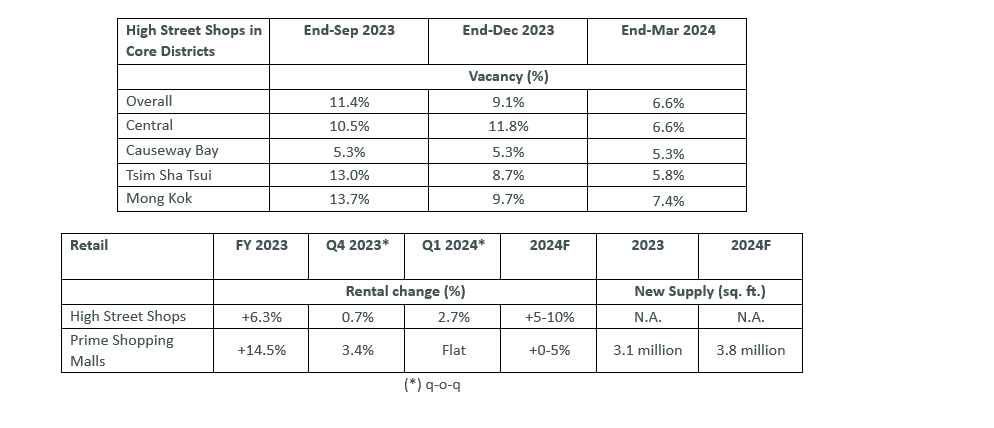

Retail

- Retail leasing momentum slowed partly due to the falling vacancy, while this quarter retail sales and visitor arrival remained on an upward trend although growing at a slower rate. Following a growth of 16.2% year-on-year over full-year 2023, total retail sales rose 0.9% year-on-year in January and 1.9% in February, increasing for the 15 consecutive months.

- Expansionary leasing demand ensured vacancy dropped by 2.5-ppt quarter-on-quarter to 6.6%, the lowest figure since Q4 2019. Vacancy across all four core districts reported the single digits, the first time since Q2 2018. Vacancy in Central logged the sharpest drop, falling 5.3-ppt to 6.6%. Tsim Sha Tsui and Mong Kok saw vacancy fall 2.9-ppt and 2.3-ppt, respectively, to 5.8% and 7.4%. Vacancy in Causeway Bay remained unchanged.

- Although F&B and luxury retailers displayed a slowdown in expansion, entertainment-related retailers were active in the quarter.

- Lower vacancy ensured high-street shop rents rose by 2.7% quarter-on-quarter, the fastest growth since Q3 2022.

Lawrence Wan, Senior Director, Head of Advisory & Transaction Services – Retail, CBRE Hong Kong: “The vacancy across four core districts dipped to the single digits, thanks to the active leasing activities over the past few quarters. The leasing momentum has softened in Q1 2024 due to the reducing options on high streets. While some F&Bs have reduced their scale of operations, many new openings were found. High-street rents have climbed up by 2.7%, the highest quarter-on-quarter growth since Q3 2022. Retailers are expected to carefully assess the recovery of Hong Kong’s inbound tourism and with the government’s efforts in launching more international events, the outlook is bright.”

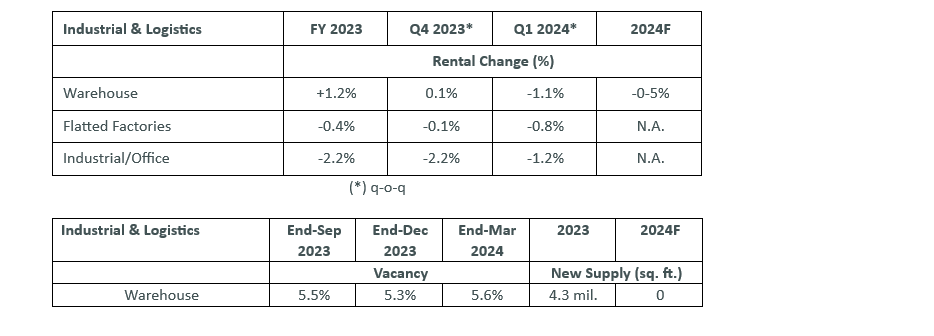

Industrial

- Aggregate trade in January and February rose 12.9% year-on-year. Should this trend continue into March, it would mark a second consecutive quarter of year-on-year growth. Container throughput increased by 3% year-on-year, the first growth since Q2 2022, while airfreight increased by 21% year-on-year.

- Leasing momentum remained weak in Q1 2024. The biggest deal involved Rhenus Logistics leasing 178,400 sq. ft. in Goodman Westlink. Other highlights included aviation supply company Silk Full Management leasing a total of 170,000 sq. ft. in Cainiao Smart Gateway.

- Warehouse vacancy rose 0.2-ppt to 5.6% and is set to increase further as tenants downsize in their current premises.

- Growing vacancy pressure ensured warehouse rents dropped 1.1% quarter-on-quarter, the first quarterly decline since Q4 2020.

Samuel Lai, Executive Director, Head of Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong: “The industrial sector has witnessed the softened leasing volume for the third consecutive quarter mostly due to the slow recovery of the Chinese economy. The quarter saw limited leasing demand mostly coming from the trade and logistics sector. While global economic headwinds may not support a rapid recovery in overall demand, the uptick in local retail sales is likely to fuel an increase in demand for storage space this year. Also, there will be relocation demand from the brownfield land resumption in the Northern Metropolis.”

Capital Markets

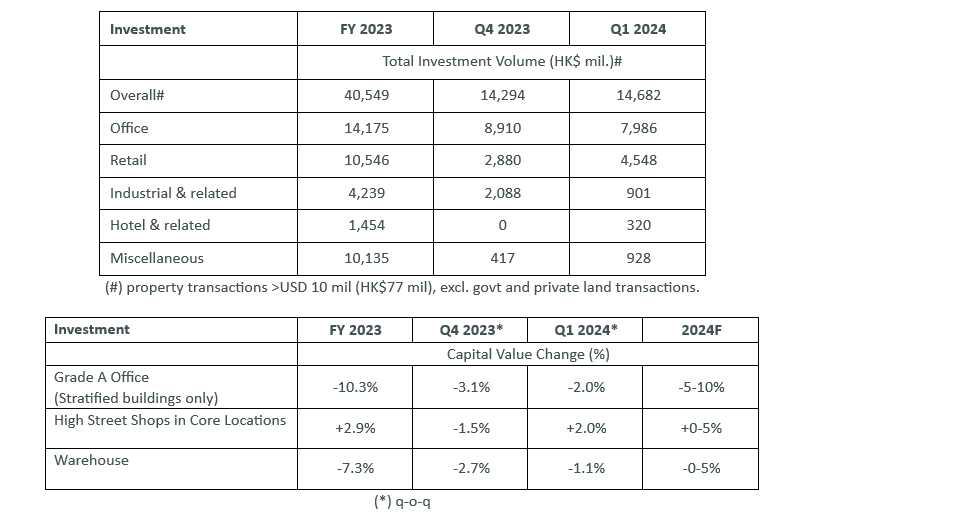

- Commercial real estate investment volume (deals worth over HK$77 million, excluding pure land or related transactions) edged down 5.5% quarter-on-quarter to HK$13.2 billion this quarter.

- Slow investment momentum was partly due to the U.S. Federal Reserve opting to keep interest rates unchanged in Q1 2024. The 1-month HIBOR dropped to 4.8% in March from 5.6% in December 2023, while Hong Kong’s Best Lending rate remained unchanged.

- Only 13 deals were completed this quarter, with two significant transactions accounting for 84% of the total investment volume. Major deals included a Taiwanese investor’s acquisition of Nexxus Building in Central for HK$7.0 billion and Chinachem’s purchase of D. PARK mall from New World for HK$4.0 billion. Most investors continued to adopt a wait-and-see approach amid the continued high-interest rate environment.

Reeves Yan, Executive Director, Head of Capital Markets, CBRE Hong Kong: “The removal of all demand-side management measures in February and the relaxation of loan-to-value ratio caps for commercial properties offer a more investor-friendly environment. However, negative carry remains a high barrier for investors under the continued high-interest rate condition. The quarter has yet to see a notable recovery in investment demand, however, the total lump sum was able to stay resilient compared with the previous quarter. During the quarter, we noticed the price correction for office and warehouse properties has slowed down while that for retail properties is going up. Should there be further signs to indicate interest rate cuts in the latter half of the year, we expect investment momentum to gradually accelerate.”