(4 August 2022, Hong Kong) It is estimated that there will be 1,700 nano flats (no greater than 20 sq m or 215 sq ft in saleable area) completed this year, nearly triple that in 2021, according to JLL’s Hong Kong Residential Sales Market Monitor released today. Combined with the impact of the relaxation on Mortgage Insurance Programme and interest rate hikes, the prices of nano flats are expected to come under pressure.

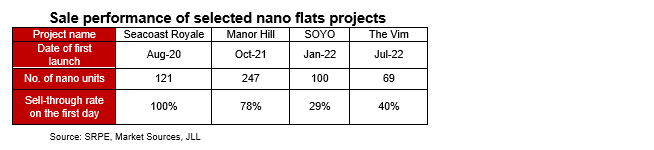

According to the Legislative Council, the median per capita living area in Hong Kong was only 16.0 sqm (about 172 sq ft) in 2021, far below other metropolitan areas like Tokyo (20.1 sqm), Singapore (33.0 sqm) and New York (49.3 sqm). With land supply staying chronically tight and housing needs unabating, many developers have opted to provide nano flats as part of the offerings so that buyers can more easily accommodate the lump sums with limited budgets. In the past several years, nano flats were relatively well received, with investors making up more than half of buyers according to JLL estimates. However, the popularity of nano flats appears to be subsiding as their sale performance has seen a visible decline. The recent launch of ‘SOYO’ in Mongkok, developed by Excel Billion and Chun Wo, sold less than 30% of the 120 units on the first day of launch. In fact, most projects with a large proportion of nano flats failed to repeat the high sell-through rates seen before.

Norry Lee, Senior Director of Projects Strategy and Consultancy Department at JLL, said: “The economic environment locally and globally has taken a turn with more uncertainties. Inflation concerns and looming recession fears have dampened investment sentiment. Figures from the Rating and Valuation Department show the rental values of Class-A units have dropped 13.1% between May 2022 and the previous peak in August 2019, when the new supply of nano flats increased. With the large volume of upcoming stock, investors are likely to be cautious about this market segment, as more rental pressure could build up and erode their investment attractiveness.”

Nelson Wong, Executive Director of Research at JLL in Hong Kong, said: “Another reason for the weaker demand is buyers for self-occupation purpose are finding it more feasible to purchase larger units given the latest relaxation in the Mortgage Insurance Programme. Such demand upgrade in turn means that more small housing units become available, adding more competition to this market segment. Also, the prospects of higher interest rates are likely to intensify further which discourage homebuying activities, investors in particular.” “In the long run, if Hong Kong succeeds in forming and creating sufficient developable land, and with the government’s intention to improve the average living space of Hong Kong people, the supply of nano flats is likely to come down as buyers’ preference shifts to the larger units,” he added.