(6 February 2023, Hong Kong) Developers are losing appetite for acquiring luxury residential sites and have shifted their focus to mass residential sites due to slow sales velocity, increasing financing costs and longer payback periods of luxury residential developments, according to JLL’s latest Residential Market Monitor released today.

Developers have become more conservative in land bidding in late 2022, with various government sites sold below or close to the lower end of market expectations. In stark contrast to a residential site (RBL 1203) in Repulse Bay breaking the government land sale record a year ago at an A.V. of HKD 62,352 per sq ft, the recent tender of a residential site (RBL 1204) in Stanley was withdrawn after all bids failed to meet the reserve price.

Joseph Tsang, Chairman of JLL in Hong Kong, said: “Luxury residential sites have lost their shine. Developers are now gravitating towards acquiring mass residential sites rather than luxury residential sites under the current weakening sentiment in the luxury housing market. Unlike mass residential projects takes only two years to pre-sales, luxury developments are mostly launched upon completion around six years after land acquisition, on average. Cash inflow does not begin to occur until then. Since the sales performances were weak in luxury housing market, the payback period would be even longer, and the developers need to afford a higher investment cost and risk.”

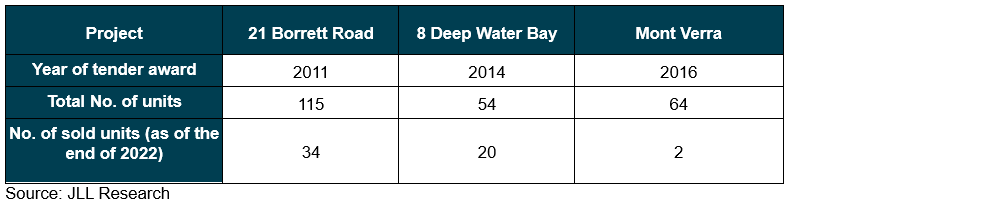

Norry Lee, Senior Director of Projects Strategy and Consultancy Department at JLL, said: “With interest rates having risen considerably in 2022 and likely to rise further, financing costs on development projects are substantially higher. Also, track records of recently completed luxury projects show that they had taken multiple years to reach reasonably high sales rates, which in turn lengthened the investment / payback period further.

For example, ’21 Borrett Road (Phase 1)’ offloaded 6 out of 115 units in 2022, compared to 28 units in 2021. Meanwhile, the new supply of luxury units has surged and may put pressure on the luxury home prices.

“The completion of Class E (saleable area of 160 sq m or above) units reached 513 units in the first 11 months of 2022, around three times higher than in 2021. Coupled with high financing costs, such projects’ expected profit margins would be eroded,” he added.

The prospects of falling luxury home prices also weakened developers’ confidence in developing luxury projects. Nelson Wong, Executive Director of Research at JLL in Hong Kong, said: “For a long time, demand for luxury units by non-locals has boosted and extended support to luxury home prices. However, the economic headwinds in mainland China and continued difficulties and hindrances in the expatriation of funds to offshore markets could result in less buying intentions and more selling pressure in the luxury sales market.”

For example, in Q4 2022, two units each at ‘Mount Nicholson’ and ’39 Conduit Road’ were reportedly sold by mainland Chinese for considerations of HKD 500 million and HKD 378 million, and at estimated losses of HKD 134 million and HKD 39 million, respectively.

Together with looming recession risks in the US and EU economies, elevated interest rates, and punitive measures on residential property transactions to stay, Wong expects the luxury residential capital values will drop by 5-10% in 2023.