(20 August 2020, Hong Kong) Amid increased uncertainty due to the city’s third wave of COVID-19, new office lettings continued to slow, dropping 14% month-on-month in July. Monthly net takeup marked the twelfth consecutive month in negative territory, amounting to -277,100 sq ft, according to JLL’s latest Property Market Monitor released today.

Following the trend of previous months, most activities occurred outside of Central as tenants looked for more affordable spaces. Among the more notable transactions, Blue Pool Capital reportedly leased 16,000 sq ft (lettable floor area) at Hysan Place in Causeway Bay to relocate and expand outside of Central, while JobsDB leased 14,700 sq ft at PCCW Tower in Quarry Bay to relocate out of a non-Grade A office space in Causeway Bay.

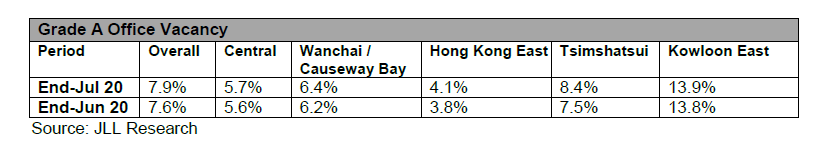

In Central, negative take-up amounted to 29,200 sq ft as the vacancy rate rose to 5.7%. Within the submarket, tenants continued to surrender spaces due to murky business prospects. As of the end of July, surrender space in the area accounted for 2.1% of the Grade A office stock in the submarket, marking the first time since January 2011 that the surrender rate was above 2% of stock.

However, rental decline did abate slightly in July. Overall office rents dropped 0.9% month-on-month last month, the first time since February 2020 that rent has fallen less than 1%. Rents in Central recorded the lowest decline at -0.7% month-on-month. The sharpest rental contraction occurred in Tsim Sha Tsui at -1.5% month-on-month, while the vacancy rate reached 8.4%, the highest among major submarkets outside of Kowloon East.”

Alex Barnes, Head of Markets at JLL in Hong Kong, said: “Immediate leasing demand remains weak as occupiers hold off from making larger real estate decisions. We expect to see more surrender space come to the market in the second half of the year as businesses realise internal occupancy strategies to save on overheads. We do however expect that medium term leasing demand will return and accelerate a greater change in occupancy behavior. There will be increased focus on better workplaces that cater to employee needs, wellness and sustainability. Location sensitivities may also be further broken down following a long work from home experiment that many companies have adopted.”

In retail market, Nelson Wong, Head of Research at JLL in Greater China, said: “Leasing activity was quiet. But some retailers catering for local customers and non-discretionary spending started to expand and set up outlets in core areas.”

According to market sources, a supermarket leased a street shop unit (5,000 sq ft) at Wah Fai Mansion in Tsim Sha Tsui with a monthly rent of HKD 300,000, marking for the first time in years that a supermarket has been present in previously tourist-packed Granville Road.