(22 May 2024, Hong Kong) Hong Kong’s overall Grade A office market recorded a positive net absorption of 248,000 sq ft in April, according to JLL’s latest Hong Kong Property Market Monitor released today.

Such was mainly due to the realisation of owner-occupied space in the completion of 1 Stubbs Road in Wanchai. Among new lettings, China Mobile Hong Kong leased two floors of a total of 47,400 sq ft (GFA) at Kowloon Commerce Centre Tower A in Kwai Chung, to expand within the building.

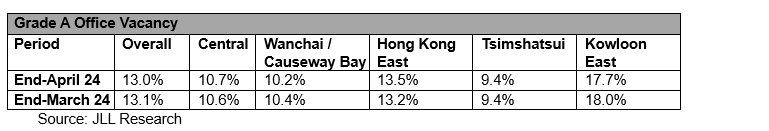

The moderate improvement in the office leasing market helped the overall vacancy rate retreat to 13.0% as at the end of April. Vacancy rates of Grade A offices in Wanchai / Causeway Bay and Kowloon East dropped 0.2 and 0.3 percentage points, respectively, while the vacancies in Central and Hong Kong East rose marginally by 0.1 and 0.3 percentage points, respectively.

Alex Barnes, Managing Director and Head of Office Leasing Advisory at JLL in Hong Kong, said: “In the short term, office rents will continue to face downward pressure due to the weak economy and the influx of new office supply. However, the rental fall will be cushioned by the decrease in new office supply in long term. We estimate the total new Grade A office in the mid-to long-term supply could decrease by about 2.0 million sq ft, following the delay in sale of Queensway Plaza in Admiralty and the proposed sharp cut of office space at Kowloonbay International Trade & Exhibition Centre redevelopment project in Kowloon.”

Cathie Chung, Senior Director of Research at JLL, said: “The decline in office rents slightly moderated in April compared to March, as the overall net effective rent dropped by 0.4% m-o-m in April, in contrast to a 0.7% fall recorded in March. Rents in Central dropped 0.2% only, compared to a 1.3% fall in March. Rents in Hong Kong East dropped further at 0.9%, while both Tsimshatsui and Kowloon East’s rentals dropped by 0.4%.”