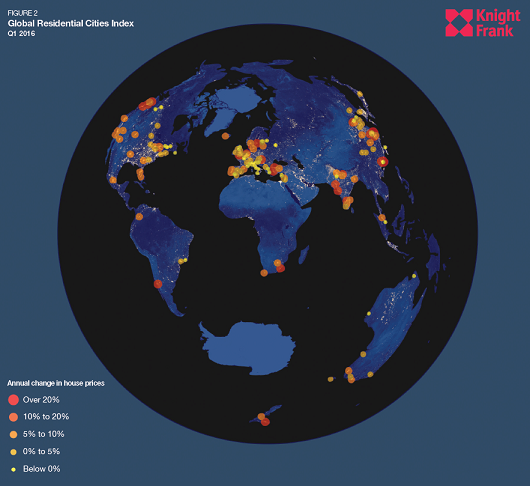

(19 July 2016, Hong Kong) Knight Frank, the independent global property consultancy, today launches the Global Residential Cities Index for Q1 2016 which tracks the performance of mainstream house prices across 150 cities worldwide based on official house price data published by either National Statistic Offices or Central Banks. The index increased by 4.5% in the year to March 2016.

74% of the cities tracked by the index saw house prices rise in the year to March 2016. The gap between the strongest and weakest performing housing market has expanded from 55 percentage points last quarter to 74 this quarter.

Results for Q1 2016

Asia Pacific cities

- Chinese cities now account for four of the world’s top five performing cities with Shenzhen leading the rankings, recording phenomenal price growth of 62.5% in the year to Q1 2016. This is followed by Shanghai (30.5%), Nanjing (17.8%) and Beijing (17.6%).

- Auckland and Lucknow are the other two Asia Pacific cities in the top 10 rankings.

- Taipei almost bottomed the list with a price drop of 8.2% in the year to Q1 2016.

- Singapore, Perth, Hong Kong, Jaipur and Taipei City are the five Asia Pacific cities sitting in the bottom 20 rankings with prices 3.1%, 4.5%, 5.0%, 5.2% and 8.2% respectively lower in the year to March 2016.

Across the world

- Scandinavia is home to five of Europe’s top ten performing city housing markets.

- Vancouver continues to be North America’s stellar performer, prices ended the year to March 17.3% higher.

- Prior to the UK’s Brexit decision, London was the UK’s strongest-performing city and Europe’s third strongest.

Post-Lehman: Brazil’s cities outperform

Looking at outperforming cities post-Lehman, Hong Kong, Kuala Lumpur, Auckland and Sydney are the four Asia Pacific cities in the top 10 rankings.

Nicholas Holt, Head of Research for Asia Pacific, says, “Shenzhen and Shanghai, two of China’s Tier-1 cities, came 1st and 2nd in the Q1 2016 Global Residential Cities Index, having seen phenomenal annual price growth rates of 62.5% and 30.5% respectively.”

David Ji, Director and Head of Research & Consultancy, Greater China at Knight Frank, says “The two cities, home to China’s major stock markets, each with a characteristic concentration of major institutions—Shanghai with banks and financial houses; Shenzhen with IT and developers—saw strong and increasing housing demand especially in downtown areas.”

To download the report, please visit:

http://www.knightfrank.com/research/global-residential-cities-index-q1-2016-3904.aspx