(10 December 2020, Hong Kong) The COVID-19 outbreak had led to a price correction across the commercial real estate leasing and investment markets in 2020. Although the volatile pandemic situation and geopolitical tensions will continue to cloud the path to recovery in the property market, the price corrections will be less severe next year. Retail properties, which recorded the sharpest fall this year, are expected to bottom out and will be the only sector to record growth in 2021, according to JLL’s Year-end Property Market Review and Forecasts published today.

Highlights of the report:

• Central’s Grade A office rent fell to the lowest level since 2015.

• Overall Grade A office recorded the highest withdrawal ever recorded.

• Overall Grade A office rents will drop 5-10% in 2021.

• Rents of High Street Shops have returned to the market level at fourth quarter of 2003.

• Rents of High Streets Shops and Prime Shopping Centres will rebound 0-5% in 2021.

• Combined with the impact from the pandemic, the narrowing price gap between Hong Kong and China on luxury goods is likely to accelerate the structural change of tourist spending profile.

• Capital values of mass residential dropped 1% in 2020, but prices of luxury residential dropped 8.2%.

• JLL urges the government to smooth out the progressive ladder of LTV ratio of properties of over HKD 10 million to allow easier upgrading, hence releasing more units in the secondary market.

• Total investment volumes for commercial properties worth over HKD 20 million have dropped to the lowest level since the Global Financial Crisis.

• Capital values of High Street Shops will rebound 5-10% in 2021. But capital values of Grade A office and Flatted Factories will drop further by 10-15% and 5-10% respectively.

Office market

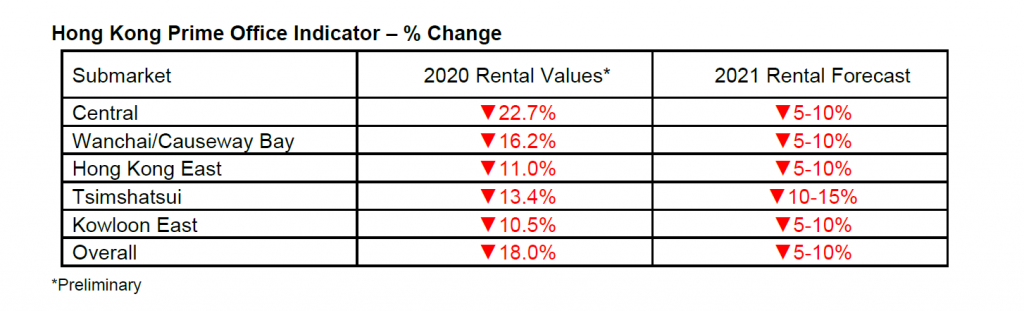

2020 is a challenging year for Hong Kong’s office leasing market, which has been hit by the economic recession, geopolitical tensions and the pandemic. Leasing demand remained subdued with the net absorption reaching -2.5 million sq ft this year, among the highest withdrawal in the office market ever recorded. New lettings in Central dropped about 39% as compared to 2019.

The vacancy rate in the overall office market rose to 8.8%, the highest level since 2004. Surrender space in the overall market also reached 1.6 million sq ft, a record high since 2001.

Rental decline in traditional business districts was more significant than decentralised locations as more tenants are seeking cost-effective options. Central’s rents dropped 22.7% YTD to HKD 93.8 per sq ft, NFA, the sharpest among the office submarkets. It has dropped 28.0% from the peak at the second quarter of 2019 and fell to the lowest level since 2015.

Alex Barnes, Head of Markets at JLL in Hong Kong, said: “Despite subdued leasing demand in the near term, gross leasing volume is expected to pick up in 2021 as tenants start making longer term real estate decisions. The vacancy rates will continue to rise in 2021, albeit at a slower pace. The rental fall would be less significant next year compared with 2020. We expect office rents to drop 5-10% in 2021 across all major office submarkets, except for Tsimshatsui, which will fall by 10-15% due to its older office stock and competition from decentralised locations.”

“Lower rents can increase the city’s competitiveness, potentially positioning Hong Kong as a more attractive location to conduct business. The secondary listings of PRC firms in Hong Kong and GBA Wealth Management Connect would attract more mainland financial institutions and related industries to set up offices in the city, which could help support office demand in the medium term,” he added.

Retail Market

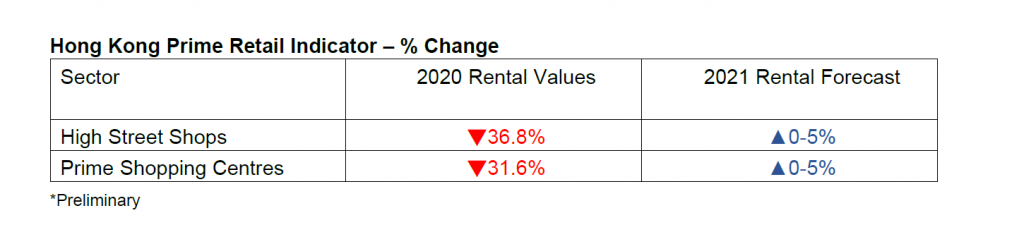

The outbreak of COVID-19 has sent Hong Kong’s retail market into deep winter. The city’s inbound tourism continued to completely stall as visitor arrivals dropped by 92.2% y-o-y in the first ten months in 2020. Only non-discretionary trades recorded growth this year, while the sales of tourist-driven retailers (jewellery and watches, electrical goods and medicines and cosmetics) dropped between 20.7% and 57.3% YTD.

The hiking vacancy pressure exerted strong downward pressure on both High Street Shops and Prime Shopping Centres rents. Rents of High Street Shops plunged 36.8% so far this year, while rents of Prime Shopping Centres slumped 31.6%.

Food and Beverage operators and mass-market retailers targeting the local market are still keen on expansion, given agreeable rental levels. But tourist-driven retailers continued to consolidate their stores in core shopping districts for cost-saving.

Oliver Tong, Head of Retail at JLL in Hong Kong, said: “The COVID-19 will likely have permanent effects on the way we go shopping. Combined with the impact from the pandemic, the narrowing price gap between Hong Kong and China on luxury goods is likely to accelerate the structural change of tourist spending profile. The retail market will heavily rely on the local consumption in short run. In the medium term, GBA one-hour living cycle could be the potential demand for retail market. But it is inevitable that landlords must implement experiential-oriented concepts into their shopping malls to increase footfall and shoppers’ dwell time. The future trade mix will weigh more on domestic consumption and target at indoor entertainment with unique features.”

“Rents of High Street Shops have returned to the market level at fourth quarter of 2003. We expect the retail market to bottom out in 2021, driven by mid-to-mass market retailers on the back of the relatively stable domestic demand with the worse to be behind us. Sales has been cut to the bone and next move is up. Rents of High Streets Shops and Prime Shopping Centres are expected to rebound 0-5% in 2021, on the back of a modest economic recovery and potentially some travel bubbles to be effected.”

Residential Market

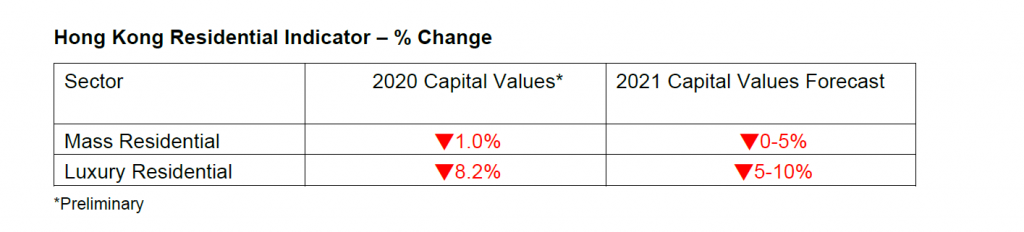

Global quantitative easing to the COVID-19 outbreak has eased the pressure on residential prices caused by a soft economy. Combined with the support of strong pent-up demand and the low level of new housing supply, capital values of mass residential dropped only 1% in 2020. But capital values of luxury residential dropped 8.2% due to the weak investment sentiment.

Similar trends were also observed in the land market. China Overseas Land bought a residential site in Kai Tak (Area 4E Site 1) for an accommodation value of HKD 13,009 per sq ft earlier this month. It was 4% above the upper end of market expectations and was broadly in line with the amount paid for a nearby site a year ago. However, the accommodation value of 37 Shouson Hill Road site sold in November was 37% less than the adjacent site at 39 Shouson Hill Road sold two years ago. It reflects developers are more cautious about luxury residential development in view of poor investment sentiment.

Joseph Tsang, Chairman at JLL in Hong Kong, said: “The low interest rate will continue to support housing demand next year. But the market activity will remain closely tied to the broader economy and unemployment trend. We expect unemployment to spike after the Employment Support Scheme (ESS) ends. Although market activity is expected to pick up mildly if the Hong Kong-China border reopens, transaction volume will remain much lower than historic levels in times of high economic uncertainties.”

In fact, the market ecology has been distorted by cooling measures, which rendered housing demand, particularly from upgraders, to focus on the primary market with easier financing schemes. Developers also focus on building small flats to keep lump-sums affordable and eligible to mortgages at higher LTV ratio. JLL urges the government to smooth out the progressive ladder of LTV ratio of properties of over HKD 10 million to allow easier upgrading, hence releasing more units in the secondary market.

Joseph expects the capital values of mass residential to drop 0-5% in 2021, while capital values of luxury residential will drop 5-10%. Rents of luxury residential will drop a further of 5-10% after it fell 13.3% this year.

Investment Market

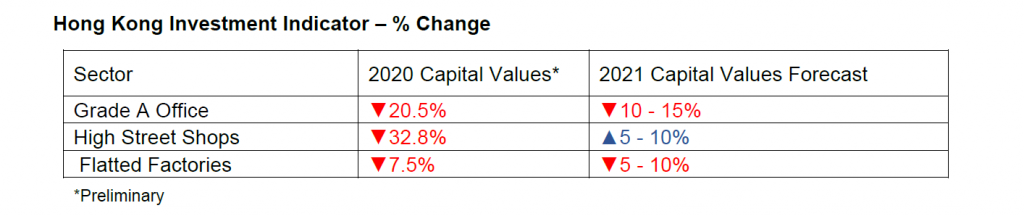

Total investment volumes for commercial properties worth over HKD 20 million have dropped 27% y-o-y to HKD 54.2 billion in 2020, the lowest level since the Global Financial Crisis. But investment activity has moderately picked up in the second half of the year as the initial phase of sharp corrections has passed.

About 44% of the total investment volumes are retail properties, taking over office to be the most active sector for investment. Investors continued to be interested in non-core retail assets with stable return and transactions over HKD 20 million were dominated by small lump-sum deals, recording an increased proportion of deals priced below HKD 50 million in terms of number of deals compared to the previous few years.

Grade A office suffered from weak occupier demand and high vacancy amid the economic recession. Capital values of overall Grade A office fell 20.5% in 2020 while those of High Street Shops plummeted 32.8%. Investors also found less incentives to engage in flatted factory redevelopment under the revitalisation scheme as office values plunged. Capital values of Flatted Factories thus dropped 7.5%.

Joseph Tsang, Chairman at JLL in Hong Kong, said: “The abolition of the Doubled Stamp Duty (DSD) on non-residential property transactions is expected to provide a fresh impetus to investment activity, especially for stratified assets with relatively small consideration. But this would likely have limited impact on en bloc transactions as most of them are conducted via company share transfers.”

“For 2021, some investors may front-run the potentially bottoming retail market. Capital values of High Street Shops are expected to recover in 2021, rebounding by 5-10%. However, capital values of Grade A office and Flatted Factories will drop further by 10-15% and 5-10% respectively,” Tsang concluded.

For further information, visit jll.com.