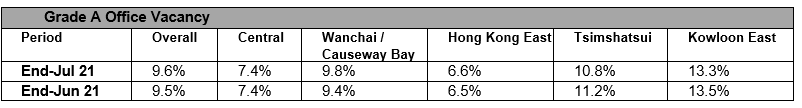

(19 August 2021, Hong Kong) Net absorption in the overall office market decreased to -89,000 sq ft in July as corporate downsizing activities have abated recently, according to JLL’s latest Hong Kong Property Market Monitor released today.

Meanwhile, the higher availability in the market offered more options to office tenants, some of whom took the opportunity to reconfigure their premises. For instance, healthcare company Bupa leased 92,500 sq ft (GFA) at The Quayside in Kwun Tong to consolidate its offices.

The vacancy rate in Central stayed at 7.4% as of end-July. Quality office buildings in the submarket have been met with greater occupier demand than the rest of the market. Notably, Henderson Land announced that The Henderson, a premium Grade A office building slated for completion in 2023, has secured its first tenant.

Alex Barnes, Head of Leasing Agency at JLL in Hong Kong, said: “Despite a handful of buildings recording slight rental growth during the month, overall net effective rents fell 0.2% m-o-m as the higher vacancy rate exerted downward pressure on rents. Among the major office submarkets, Wanchai/Causeway Bay and Kowloon East experienced relatively larger rental decline.” On the retail side, Nelson Wong, Head of Research at JLL in Greater China, noted: “Retail leasing momentum continued to improve in July. Retailers were able to take up prime locations at a fraction of the peak level rents. Notably, a watch retailer has reportedly committed to a ground floor shop (1,093 sq ft) at Aon China Building in Central for a monthly rent of HKD 500,000, 78% less than its peak level rent.”