[Hong Kong, 22 September 2025] Despite facing structural challenges such as interest rate pressure, softening demand, and oversupply, Hong Kong’s office market is gradually showing signs of a demand rebound.

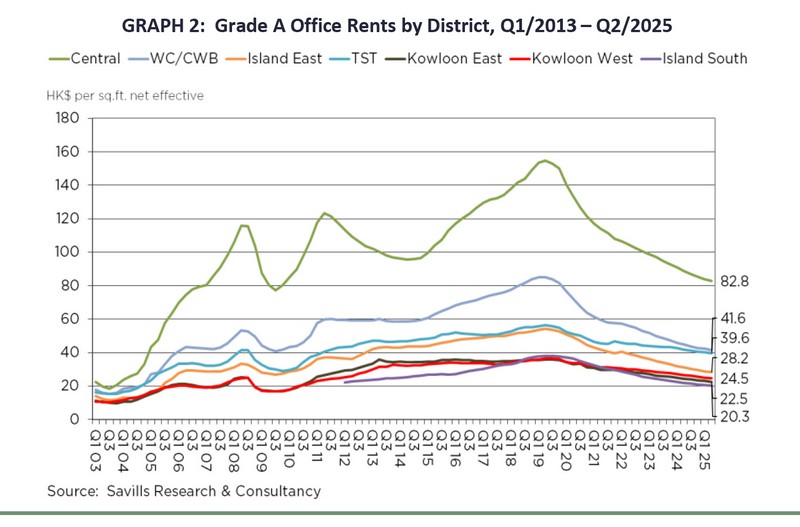

The recovery of the financial sector, active acquisitions by end-users, and policy-driven relocation demand are injecting new momentum into the market. In particular, Grade A buildings in Central are performing strongly, with rents expected to be the first to rebound in the coming years, according to Savills in its Market in Minutes – Hong Kong Office Leasing report for September 2025. For details, please read the attached report.

Prime Grade A Offices in Central Remain Highly Sought After, with Rents Steadily Rebounding: Small to medium-sized hedge funds and quantitative funds are actively looking for spaces of 1,500 to 5,000 square feet in Central’s core, driving demand for landmark buildings such as IFC, AIA Central, and Chater House, where rents remain at HKD 110–130 per square feet.

Secondary Locations Face Competitive Pressure, with Rents Continuing to Decline: Office rents in Central’s secondary locations generally range from HKD 40 to 60 per square feet, facing direct competition from high-quality Grade A offices in Causeway Bay and West Kowloon. Some financial tenants are considering relocating to these surrounding districts.

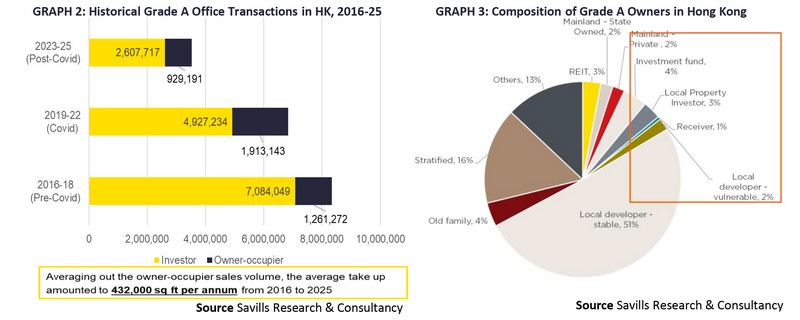

Active End-User Acquisitions Effectively Reduce Market Supply: The 2025 financial year saw several major self-use transactions, with institutions such as HKUST, the Law Society of Hong Kong, and the Employees Retraining Board collectively absorbing over 430,000 square feet. Their long-term holding strategies help halt the market’s continued decline.

Government Policies Drive Relocation Demand, Benefiting Grade A Offices: New policies allowing commercial buildings to be converted into student accommodation are expected to generate 845,000 square feet of annual relocation demand, about half of which will be absorbed by Grade A offices in the area, providing fresh impetus for market recovery.

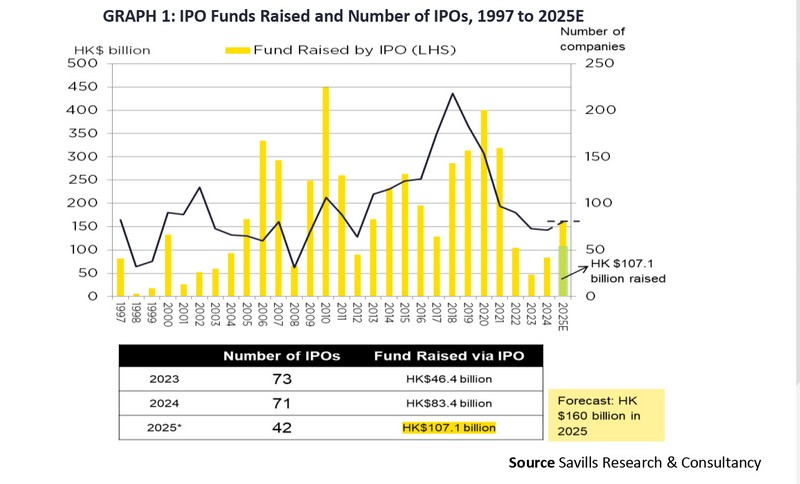

Strong IPO Market Recovery Boosts Demand for Financial Services: Hong Kong reclaimed the top spot globally for IPO fundraising in the first half of 2025, raising over HKD 107.1 billion. This is expected to create significant opportunities for investment banks and professional service firms, further supporting demand for office space in core districts.

Mr. Jack Tong, Director, Research & Consultancy of Savills commented, “Despite interest rates pressure and softening demand presenting immediate challenges to office leasing market, new drivers are emerging in Hong Kong’s office sector. This is driven by a resurgent financial sector and robust end-user sales activity, with office rents in Central expected to recover ahead of the broader market over the next few years.”

Mr. Ricky Lau, Managing Director, Head of Leasing of Savills said, “Assuming a continued recovery in the financial sector, annual office absorption is projected to return to pre-COVID levels of 1.3 million square feet, followed by an additional 400,000 sq. ft. from end-user acquisitions and another 400,000 square feet from displacement demand, this would bring the total annual absorption to 2.1 million square feet under this optimistic scenario, vacancy rates were expect”

Mr. William Yiu, Deputy Senior Director, Kowloon Office Leasing of Savills said, “Under this optimistic scenario, vacancy rates were expected to peak at 16% in 2026 before gradually declining to 6% by 2030, potentially triggering a rebound in office rents.”