(24 May 2021, Hong Kong) An overall net withdrawal of 99,400 sq ft was recorded in the Grade-A office market during April, according to JLL’s latest Hong Kong Property Market Monitor released today.

The vacancy rate in Central rose to 7.5% as of end-April, with leasing activity mainly involving tenants moving within the submarket. Notably, China Life Franklin Asset Management reportedly leased a floor (13,900 sq ft, NFA) at One Exchange Square, relocating from Cheung Kong Center.

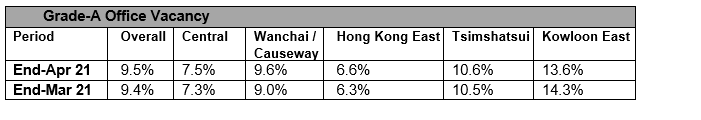

Due to persistently heightened vacancy pressure, rents in the overall Grade-A office market dropped by 0.9% m-o-m. Tsimshatsui experienced the biggest rental decline among the major office submarkets, while Hong Kong East saw relatively stable rents.

Alex Barnes, Head of Office Leasing Advisory at JLL in Hong Kong, said: “With many tenants still in cost-saving mode, the corporate downsizing trend continued in April. Occupiers have begun to reconfigure their post-pandemic real estate requirements, leading to rising demand for quality office buildings. We believe flight to building quality will remain a consistent market theme moving forward.” In terms of the industrial market, Nelson Wong, Head of Research at JLL in Greater China, noted: “The leasing market for warehouses picked up momentum in April, with a modest rise in expansions to accommodate business needs. Supply chain service provider SF Supply Chain, for example, expanded its presence at Tuen Mun Distribution Centre Block 1, leasing approximately 32,000 sq ft. Among the various property segments, industrial assets are catching more attention from institutional investors, with three major transactions reportedly concluded in April by investment funds with total consideration of around HKD 4.5 billion.”