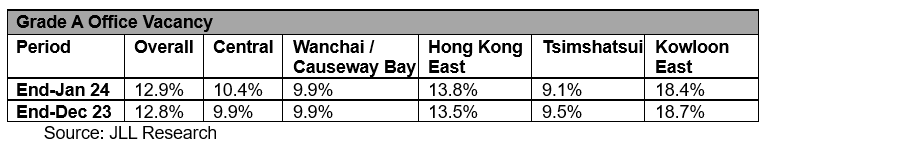

(27 February 2024, Hong Kong) According to JLL’s latest Hong Kong Property Market Monitor released today, the overall vacancy rate of overall Grade A offices in Hong Kong rose to 12.9% as at end-January, driven by new completion.

The overall Grade A office market recorded a positive net absorption of 160,800 sq ft in January, primarily contributed by the realisation of pre-committed space of The Henderson in Central which was completed during the month.

However, the rise in new office supply has affected the overall vacancy rate at the same time. Notably, Central’s vacancy rate rose to 10.4% as at end-January, but vacancies in Tsimshatsui and Kowloon East both dropped 0.4 percentage points.

Alex Barnes, Managing Director and Head of Office Leasing Advisory at JLL in Hong Kong, said: “The office leasing market is predominantly fuelled by office upgrades as rents have dropped substantially from their market peak. The increase in new office completions has been a driving force behind tenants seeking high-quality office spaces to enhance their working environment. This trend has resulted in new buildings with reputable green certifications outperforming others in the market. We believe the upgrading demand will continue to drive the market this year.”

One of the major transactions recorded during the month was Franklin Templeton leased a lettable floor area of 23,600 sq ft at Two International Finance Centre in Central, to relocate from Chater House in the same district.Cathie Chung, Senior Director of Research at JLL, said: “Overall net effective rent of Grade A offices dropped further by 0.6% m-o-m in January. Among the major office submarkets, rents in Central and Hong Kong East dropped further by 1.2% and 0.9%, respectively, while Tsimshatsui’s rental remained flat.