(8 July 2024, Hong Kong) Slow recovery in inbound tourism with persistently high financing costs and an uncertain geopolitical environment continued to set the scene for the first half of 2024. Against this backdrop, demand for Hong Kong’s commercial real estate remains overall weak, with particularly in sales volume in the investment market. Office leasing velocity, however, was on the rise in H1 2024, according to CBRE Hong Kong’s 2024 H1 Market Review.

“Midway through the year, Hong Kong’s commercial real estate market is confronting global headwinds ranging from the high interest rate environment and China’s slow recovery to continuous geopolitical tensions. Commercial real estate demand remained overall weak in H1 2024. Investors and occupiers continued to be overall cautious, resulting in limited new and expansion demand across sectors. Despite the challenges, the office leasing market improved year-on-year in H1 2024,” said Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong.

Review and Commentaries

Grade A Office

- Leasing volume softened in Q2 2024 compared to the previous quarter when several major relocations and quasi-government leasing deals were completed. Gross leasing volume fell 27% quarter-on-quarter to 1.0 million sq. ft. Over 30% of activity occurred in buildings completed after 2021. For H1 2024, office leasing volume heightened for the fourth consecutive quarter to 2.3 million sq. ft., the highest half-yearly total since H1 2019.

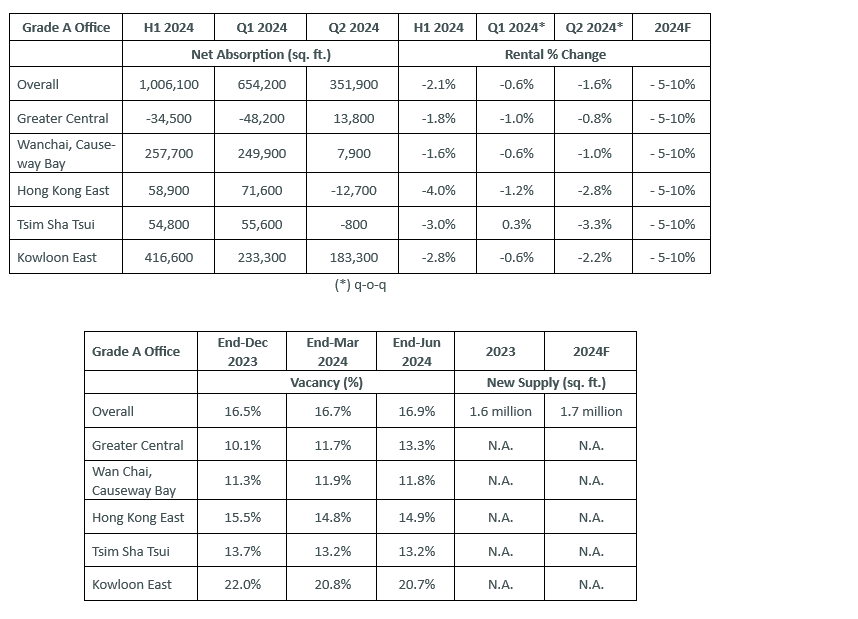

- Net absorption totalled 351,900 sq. ft., staying positive for a fourth consecutive quarter, partly due to newly-leased space in recently-completed buildings. For H1 2024, net absorption registered 1.0 million sq. ft., the most for a half-yearly period since H2 2018. Central saw 39,800 sq. ft. of net absorption in Q2 2024 and 35,400 sq. ft. in H1 2024, mainly driven by improved occupancy in The Henderson. Thanks to several major commitments in AIRSIDE, Kowloon East remained the best-performing submarket, logging 183,300 sq. ft. of net absorption quartering Q2 2024 and 416,000 sq. ft. in H1 2024.

- New supply totalled 631,100 sq. ft. in Q2 2024, bringing the half-yearly total to 1.5 million sq. ft. Citywide vacancy reached 15.0 million sq. ft. or 16.9%. Central vacancy rose to 14.0%, marking the first time since June 2004 that vacancy in this submarket has reached the 14% threshold. New supply also ensured Central also registered the sharpest jump in vacancy of any submarket in H1 2024, logging an increase from 9.7% to 14.0%.

- The vacancy overhang ensured rents fell 1.6% quarter-on-quarter, accelerating from the drop of 0.6% quarter-on-quarter seen in Q1 2024, bringing the half-yearly decline to 2.1%. Despite an increase in space availability, Central rents dropped the least, falling by 0.5% quarter-on-quarter.

Ada Fung, Executive Director, Head of Advisory & Transaction Services, CBRE Hong Kong: “The Grade A office leasing market sentiment has improved with positive net absorption recorded for the fourth quarter in a row. The demand for office space has been largely stable, newly completed office space, particularly in decentralised locations, is gaining popularity as some occupiers choose to upgrade their offices at affordable rents. For the remainder of the year, leasing demand is expected to strengthen further as overall economic momentum and financial market sentiment further improves. High vacancy rates and new supply will likely continue to drive rents downward.”

Retail

- Leasing momentum softened quartering H1 2024 due partly to reduced space availability and rising uncertainty towards consumers’ spending patterns. Total retail sales declined by 6.1% year-on-year in the first five months of 2024.

- F&B groups continued to be a major source of leasing demand, contributed 197,000 sq. ft. of leasing volume this quarter. While demand from watch and jewellery retailers and pharmacies slowed due to the slow rebound in visitor arrivals, low rents supported entry and expansion by fashion brands in core districts.

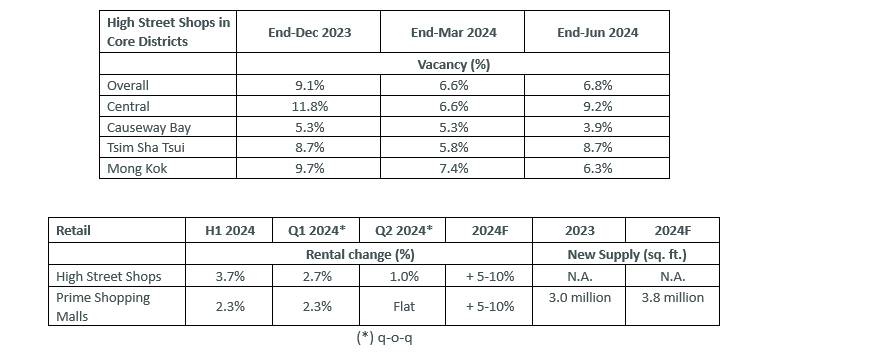

- Vacancy edged up by 0.2-ppt q-o-q in Q2 2024, but improved noticeably from 9.1% at end-2023.. Vacancy in Central improved from 11.8% to 9.2% while that in Tsim Sha Tsui was largely flat during the half-yearly period. Causeway Bay also saw vacancy improved from 5.3% to 3.9% in H1 2024, while Mong Kok observed noticeable improvement from 9.7% to 6.3% during the same period.

- Slower leasing momentum ensured a marginal slowdown in rental growth, with overall rents increasing by 1.0% quarter-on-quarter in Q2 2024, compared to 2.7% quarter-on-quarter in Q1 2024. This brought the half-yearly growth to 3.7%.

Lawrence Wan, Senior Director, Head of Advisory & Transaction Services – Retail, CBRE Hong Kong: “While the leasing momentum has slowed in the first half of 2024, it has still managed to surpass the levels seen in 2018/2019 level. The slowdown was largely due to a downturn in retail sentiment and fewer available options on high streets. The primary drivers of leasing activities in the first half of the year were the F&B, clothing & footwear retailers, and pharmacies. We observed a varied performance within the F&B sector, with most groups reporting an uptick in year-on-year restaurant receipts, except for bars in Q1 2024. Currently, high-street shop rents are approximately 30% lower than the peak in 2019.”

Industrial

- Aggregate trade in April and May rose 9.8% year-on-year. Should this trend continue into June, it would mark a third consecutive quarter of year-on-year growth. Container throughput decreased by 6.7% year-on-year, while airfreight increased by 16.5% year-on-year.

- Leasing momentum weakened further in Q2 2024. The biggest deal involved YA Logistics leasing 147,500 sq. ft. in Mapletree Logistics Hub Tsing Yi, followed by Dubai-based logistics company Aramex leasing 39,100 sq. ft. in interlink.

- Warehouse vacancy rose 2.5 percentage points to 7.9% mainly due to the release of space in Cainiao Smart Gateway previously reserved by the landlord.

- Persistent vacancy pressure caused warehouse rents to drop 1.5% quarter-on-quarter, marking only the second quarter-on-quarter decline reported since Q4 2020.

Samuel Lai, Executive Director, Head of Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong: “The industrial leasing sector has experienced a decline for the fourth quarter in a row, primarily due to the slow recovery of China’s economy. However, we have observed an improvement in the business environment for trade and logistics companies, as evidenced by the increase in business receipts across the trading, warehousing, and courier sectors. While adequate trade activities will support Hong Kong’s economy for the year, the outlook is clouded by the upcoming U.S. election and geopolitical tension. The increased vacancy rate, resulting from the release of space in Cainiao Smart Gateway, has led to a 2.6% decrease in rents in the first half of 2024, compared to the second half of 2020.”

Capital Markets

- Deep negative carry continued to constrain investment momentum in Q2 2024. The 1M-HIBOR remained high despite falling from 4.80% at end-March to 4.66% in June, while Hong Kong’s Best Lending rate remained unchanged.

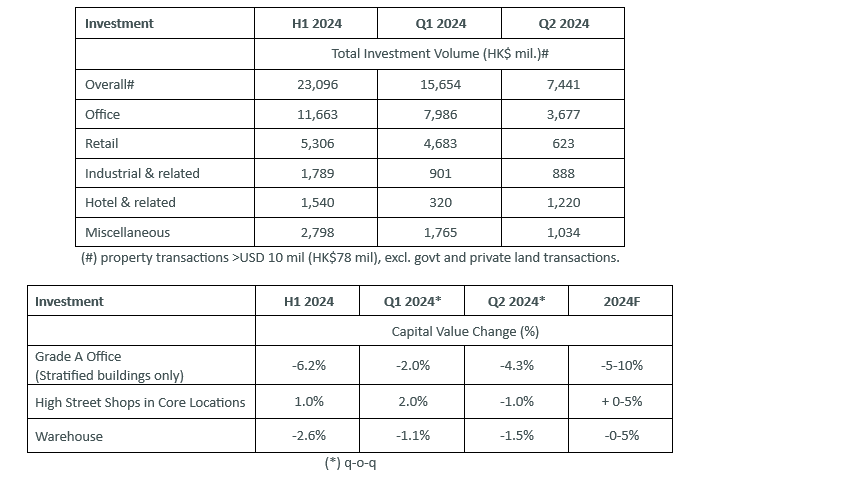

- Commercial real estate investment volume (deals worth over HK$77 million) fell 52.5% quarter-on-quarter to HK$7.4 billion this quarter. This brought the total for H1 2024 to HK$23.1 billion, the second-lowest half-year total since H2 2008. During H1 2024, the highlight was on financially-stressed assets where sellers dispose to fulfill loan covenants. Financially-stressed assets accounted for HK$16.8 billion of the investment volume or 73% of the total investment volume in H1 2024.

- Only 48 deals were closed in H1 2024, the least for a half-yearly period since H2 2008. Of these transactions, 35 (or 73% by number of count) involved a lump sum of less than HK$300 million.

- Amid the small number of deals, office still accounts for the most transactions (15 transactions). Retail was slow with only 10 retail deals in H1 2024.

- The investment market is still dominated by local investors by number of deals (22 transactions or 45% of H1 2024’s total count of 48). Local investors and end-users mostly bought office floors.

Reeves Yan, Executive Director, Head of Capital Markets, CBRE Hong Kong: “The investment market has entered a slower phase, as impacted by high financing costs, negative carry positions and uncertain global geopolitical tensions. The market was supported by just a few larger deals in Q1, followed by an increase in smaller-sized deals in Q2 with local investors and developers remaining the major buyers. Over the past 12 to 18 months, student accommodation has emerged as a popular sector for institutional investors, with en-bloc hotels or apartment blocks being acquired for conversion into student accommodation. While most investors continued to adopt a wait-and-see attitude under the high interest rate environment, some long-term-minded family offices continue to invest in office assets.”

• Samuel Lai, Executive Director, Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong

• Lawrence Wan, Senior Director, Advisory & Transaction Services – Retail, CBRE Hong Kong

• Ada Fung, Executive Director, Head of Advisory & Transaction Services, CBRE Hong Kong

• Reeves Yan, Executive Director, Capital Markets, CBRE Hong Kong

• Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong