(7 March 2024, Hong Kong) Swire Properties has been recognised by the financial industry for its pioneering efforts in promoting green financing in the real estate industry and in Hong Kong, with the Company’s successful launch of the city’s first and the largest-ever corporate public Renminbi (RMB) 3.2 billion green bonds (“green dim sum bonds”) in 2023.

(按此瀏覽中文版)

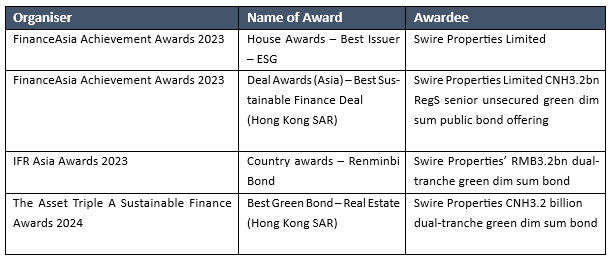

Swire Properties won the Best ESG Issuer in Asia at the FinanceAsia Achievement Awards 2023, topping over 680 high-calibre organisations for this coveted honour. Furthermore, the green dim sum bonds offering received three awards at the FinanceAsia Achievement Awards 2023, IFR Asia Awards 2023 and The Asset Triple A Awards 2024 respectively.

Tim Blackburn, Chief Executive of Swire Properties said, “This recognition by the financial community for our green financing efforts is very encouraging. This reinforces our commitment to integrating sustainability into every facet of our business, including our financing arrangements.

“The capital resources secured in the green financing market will allow us to break new ground, create the next generation of green buildings, and integrate cutting-edge green technologies and renewable energy solutions into our projects; all aligned with our vision to become the leading sustainable development performer in our industry globally by 2030.”

Fanny Lung, Finance Director of Swire Properties said, “Moving forward, we’ll continue to pursue our target of a minimum of 80% of bond and loan facilities from green financing by 2030. This echoes with the HKSAR Government’s master plan on green transition and carbon neutrality, and will ensure that we continue to do our part to develop Hong Kong into an international centre for green tech and finance.”

Fanny Lung, Finance Director of Swire Properties, received the Best ESG Issuer in Asia award at the FinanceAsia Achievement Awards 2023 on behalf of the Company.

FinanceAsia Achievement Awards 2023 House Awards – Best Issuer – ESG Swire Properties Limited

Pioneer in Green Financing

The Company’s commitment to green financing began in 2018 with its inaugural green bond. As at December 2023, green financing accounts for approximately 60% of the Company’s overall bond and loan facilities – with green and sustainability-linked loan facilities totalling HKD21 billion and green bonds totalling HKD11.9 billion. The Company has already achieved its 2025 KPI of having a minimum of 50% in green financing, two years ahead of schedule.

The proceeds fund green projects in the areas of green building development, energy efficiency, renewable energy, sustainable water, waste-water management and climate change adaptation. Through green financing – specifically green bonds, green loans and sustainability-linked loans – Swire

Properties is not only supporting the transition to a low-carbon, more resource-efficient and sustainable economy, but also improves the wellbeing of tenants, visitors, colleagues and people in local communities by designing and building sustainable projects.

The award-winning dual-tranche green dim sum bonds mark Swire Properties as the first Hong Kong corporate to issue a RMB-denominated public green bond, and the first Hong Kong corporate to return to the public dim sum bonds market since 2019. The transaction also represents the largest-ever corporate green dim sum bonds issuance in Hong Kong.

Visit Swire Properties’ website at www.swireproperties.com.

List of Awards: