(14 March 2024, Hong Kong) Northern Metropolis will take two decades to come into realisation and will require existing brownfield users to be relocated to facilitate high-rise and infrastructure development, triggering new industrial leasing demand despite the city’s current shortage of available industrial space, according to the CBRE’s latest research report “Brownfield land resumption in the Northern Metropolis: What does it mean for industrial real estate?”

“The plan encompasses 1,500 hectares of brownfield sites currently in use and approx. 65% of the brownfield operations will need to be relocated in the next 10-15 years, involving over 1,000 hectares of scattered land resources. We foresee that the relocation of brownfield land users will induce 31 million sq. ft. of underlying demand for different types of industrial properties, creating significant opportunities for industrial landlords and brownfield users,” said Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong.

The brownfield economy

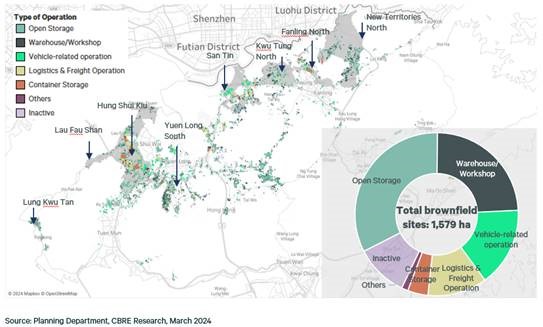

Brownfield sites are commonly used for industrial activity either not suitable for upstairs operations or by those with budget and space constraints. Storage is a common use. Within the Northern Metropolis area, 33% of brownfield sites under study are used for open storage; 24% for warehouses/workshops; 16% for vehicle-related operations; and 12% for logistics & freight operations.

Many of these industries are capable of running operations on higher floors of traditional brick-and-mortar industrial buildings, with CBRE estimating that about 30% of such operations will ultimately be moved upstairs. However, many brownfield sites are currently large in size and will require sizable traditional industrial space when relocations happen.

“While the government has spared efforts to assist affected users such as offering alternative short-term leases, with low vacancy of 5.3%, no new supply till 2027 and such a large-scale relocation demand in the industrial market, we expect there will be intense competition for space when users are forced to relocate. The potential shortage is expected to be as much as 15.5 million sq. ft. of industrial space during 2024-2029,” said Samuel Lai, Executive Director, Head of Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong.

Need for adopting warehouse automation and high-specification industrial buildings

To make upstairs relocations financially viable, logistics operators are advised to leverage automation technology. Warehouse automation allows logistics operators to reduce labour costs and improve accuracy, efficiency, inventory management and productivity throughout the logistics chain. Automating a warehouse plant can help offset real estate efficiency trade-off encountered in the transition from tin sheds to multi-storey premises.

By adopting modern logistics technologies, leading industry players have achieved 30%-80% gains in storage capacity. Multi-storey warehouses also offer occupiers greater security and power supply provisions, thereby facilitating more sophisticated operations and effective storage of high-value goods.

However, not all industrial buildings are suitable for warehouse automation, which typically requires a minimum ceiling height of 4m, high floor loading capacity, large floorplate and wider column spacing. Also, rental premiums could potentially reach as high as 50% to 100% compared with brownfield tin sheds.

Logistics operators also have to consider risks arising from short outsourcing contract terms and real estate leases. Longer commitments allow investors to spread the cost of investment over a longer period, resulting in better return on investment. Landlords should consider signing longer leases with logistics operators that exceed the traditional three to six-year term.

On the other hand, many industrial occupiers shifting to capital-intensive and knowledge-based operations are seeking buildings with higher specifications. With Hong Kong’s import/export market transformed with high-tech products accounting for 68% of total trade in 2022, logistics for cold-chain, healthcare, medical and pharmaceutical products have grown significantly during the pandemic. Many high-value users such as those involved in cold chain logistics, specialty goods logistics, e-commerce, and data centres, now require buildings with larger floorplates, higher ceilings, greater floor loading capacity, and stronger power availability. “The development of the Northern Metropolis will require the resumption of brownfield land, which will generate substantial relocation demand from current occupants of brownfield sites, thereby creating significant opportunities for industrial landlords. Industrial occupiers are advised to move swiftly to secure suitable properties for relocation, as competition for land will be intense in the short term. Industrial landlords are recommended to upgrade building specifications to accommodate the requirements of those industrial space users who will need to relocate,” added Samuel Lai.

Photo caption (from left to right):

Samuel Lai, Executive Director, Head of Advisory & Transaction Services – Industrial & Logistics, CBRE Hong Kong

Marcos Chan, Executive Director, Head of Research, CBRE Hong Kong