(10 April 2024, Hong Kong) Global real estate services firm Cushman & Wakefield today held its Hong Kong Property Markets Q1 2024 Review and Outlook press conference. Following the Government’s announcement in the latest Budget that it would lift all demand-side management measures for residential properties, the market responded positively, with primary and secondary residential transactions strengthening notably and home prices picking up from March onwards. In the office sector, overall net absorption in Q1 remained positive, with the quarter also witnessing a y-o-y rise for new lettings, despite the high availability rate keeping rents under pressure. For retail, visitor spending continued to support a steady recovery in the market, with the overall high street vacancy rate remaining broadly stable.

Grade A office leasing market: Net absorption stayed positive in Q1 2024, companies seeking upgrading and relocation opportunities

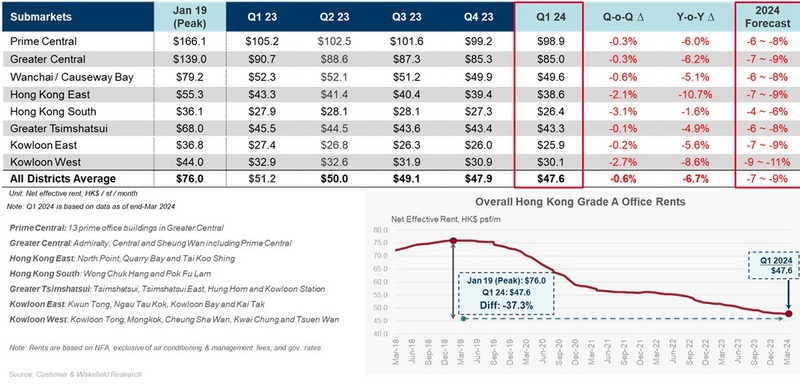

Overall net absorption of Grade A office space in Q1 remained positive at 264,200 sq ft, mainly driven by large-scale leasing transactions at new projects in Kowloon East, with the submarket recording net absorption of 289,700 sq ft. Four new office buildings completed in the quarter, located in Greater Central, Wan Chai/Causeway Bay, Hong Kong South, and Kowloon West. The expansion of leasable office space brought the availability rate up to 19.6%. Rental levels remained under pressure in the quarter, but the pace of decline was slower, edging down 0.6% q-o-q in Q1, and 6.7% y-o-y (Chart 1).

Chart 1: Rents of Grade A offices in Hong Kong

In terms of new letting activities, a total of 889,000 sq ft of leased space was recorded in Q1, an increase of more than 40% y-o-y. Kowloon East was the most sought-after submarket, accounting for more than 40% of the newly leased space, with the district benefitting from attractive rents with a greater offering of new prime quality buildings and ESG-certified office space. By business sector, the public sector (23%) accounted for the highest share of newly leased space, while the banking and finance (21%), professional services (15%) and insurance (13%) sectors also recorded double-digit shares.

John Siu, Managing Director, Head of Project and Occupier Services, Hong Kong, Cushman & Wakefield,said, “We have observed several large-scale office leasing transactions over the quarter, while the total new lettings in the past three quarters were higher than the five-year quarterly average of 640,000 sq ft, indicating a relative improvement in leasing sentiment. Currently, many multinational companies are making ESG a key requirement when choosing local offices. With more new office buildings scheduled for completion this year, there will be a greater spectrum of quality offices with international ESG building certifications available in the market, which will encourage more upgrading and relocation activities to take place while rents are still attractive.”

Retail leasing market: Overall high street vacancy rate stabilized, rents across districts rose steadily

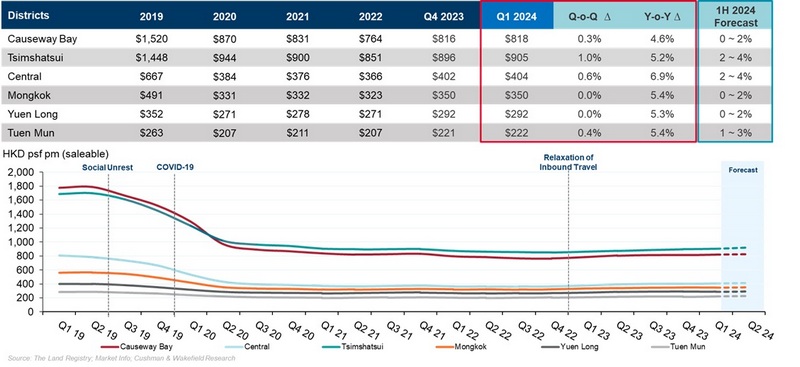

Against the backdrop of changing consumption patterns from both tourists and residents, total Hong Kong retail sales for the January to February 2024 period combined recorded HK$70.3 billion, growing at a modest 1.4% y-o-y, a somewhat slower pace compared to last year. Among retail categories, sales of Medicines & Cosmetics recorded y-o-y growth of 21.7%, followed by Jewellery & Watches and Fashion & Accessories at 8.8% and 7.4%, respectively. Supported by tourist spending, the overall high street vacancy rate largely stabilized. Retail leasing activities were relatively more concentrated on Hong Kong Island in Q1, with the vacancy rate in Central dropping by 1.5 percentage points q-o-q to record 7.0%, while vacancy in Causeway Bay remained stable at 2.6%. However, with some festive period pop-up stores now departing high streets, vacancy rates in Mongkok and Tsimshatsui rose to 11.1% and 11.8%, respectively.

Despite the city’s inbound tourism recovery, the structural shift of Hong Kong residents more frequently traveling northbound to spend in the Greater Bay Area mainland cities has hindered local consumption in town, in turn dampening recovery in retail rent growth. As a result, high street rents across retail districts recorded mild growth in Q1, ranging from 0% to 1% q-o-q. In the F&B sector, local operators generally remained cautious, leading to softer growth for F&B rents. Causeway Bay and Central F&B rents edged up 1% q-o-q, while Tsimshatsui and Mongkok recorded a drop of 2% q-o-q.

Chart 2: High street retail rents in prime districts in Hong Kong

Kevin Lam, Executive Director, Head of Retail Services, Agency & Management, Hong Kong,

Cushman & Wakefield,commented,“Retail leasing and expansion activities in the past quarter were concentrated on Hong Kong Island. While rents are still at an attractive level, retailers are looking for consolidation and relocation opportunities in prime locations. Although the trend of Hong Kong residents traveling more frequently northbound to spend in mainland cities has hindered local consumption and hence rental recovery, we believe that the government initiatives to promote the city’s tourism and develop a mega event economy could help generate footfall on high streets, as well as giving a further boost to tourist retail spending.

“At the same time, the Individual Visit Scheme has been further expanded to more mainland cities, and it is expected to benefit trades such as the F&B and medicines & cosmetics sectors. What’s more, Hong

Kong Immigration Department data shows that the number of new applications approved under various talent and admission schemes in 2023 was four times higher than that in 2022. The arrivals of talent and their families will in turn become a new source of spending power in the local market. We have also seen mainland retailers becoming more active in entering the Hong Kong retail market. Apart from some popular mainland F&B chains, experiential retail, lifestyle and athleisure brand names are also actively exploring expansion opportunities in Hong Kong, offering a diversity of brand-new consumer experiences to the city’s retail ecosystem. We expect retail rents to maintain modest and low single-digit growth in 1H 2024.”

Residential market: Housing market bottomed out in February following budget announcement, home prices now expected to rebound 0% to 3% in 1H 2024

The residential market finally witnessed a rebound in Q1 2024. Although overall residential transactions remained subdued in January and February before the Hong Kong Government Budget announcement, market sentiment improved notably following the government’s decision on February 28 to completely withdraw all demand-side management cooling measures in the housing market (known as “spicy measures”). Developers took advantage of the situation and actively launched new projects, while potential buyers, investors, and non-local buyers all became active again in seeking residential properties. This supported transactions in both primary and secondary markets. Total residential transaction numbers climbed 29% q-o-q to reach around 9,820 units in Q1 2024, although this still represented a drop of 30% y-o-y. In the month of March, residential transactions rebounded to more than 3,970, marking a significant monthly increase of 67% (Figure 3).

Chart 3: Number of residential sale & purchase agreements

Source: Land Registry, Cushman & Wakefield Research

Edgar Lai, Senior Director, Valuation and Consultancy Services, Hong Kong, Cushman & Wakefield, mentioned, “The Rating and Valuation Department data shows that overall residential prices in January and February continued to decline, which combined a 2.9% drop from end-2023, and resulted in a 14.6% decline over the past ten months. However, according to Cushman & Wakefield’s small to medium-sized residential price index, home prices bottomed out in February and started to rebound after the withdrawal of all the cooling measures, with a monthly increase of around 1.5% in March. Home prices in all our market segments have turned from a decline to a rise since March. Among the segments, the price level rose most notably in City One Shatin, representing the small-sized market, with a monthly increase of 14.2% in March and a quarterly increase of 10.7%. Taikoo Shing, representing the middle-sized market, recorded a 1.4% monthly increase in March, but still a slight correction of 1.4% over the quarter. As for the luxury segment, Residence Bel-Air saw a 0.8% increase in March, with an overall 2.1% decrease in Q1 2024.”

Rosanna Tang, Executive Director, Head of Research, Hong Kong, Cushman & Wakefield, added, “Looking ahead, with the complete withdrawal of cooling measures by the government, market confidence is gradually stabilizing and improving. While developers actively promote their new projects, the supply of second-hand properties has also increased, leading to a notable rebound of transaction volume in both primary and secondary markets. This also indicates that pent-up demand is being gradually released from first-time buyers, upgraders, non-local buyers, and even investors after the withdrawal of cooling measures. We forecast a 30% to 40% rebound in residential transaction volume for the full year of 2024, reaching a level of 55,000 to 60,000 units. As for home prices, we believe that the pricing level has now bottomed and will stabilize, although a significant rebound is not likely. The housing market is still facing economic uncertainties amid a high interest rate environment. This is combined with abundant supply in the primary market, where developers are keeping asking prices aligned to the market, in turn limiting homeowners’ ability to raise prices in the secondary market. For 1H 2024, we expect the overall residential price to mildly recover in the range of 0% to +3%. If the US Federal Reserve confirms interest rate cuts in 2H 2024, we anticipate a potential full-year price rebound to reach +5% to +7%.”