(30 October 2018, Hong Kong) Increasing public housing supply could affect the demand for nano flats in more remote locations, according to JLL’s latest Residential Sales Market Monitor released today. The firm expects developers would build more livable flats with bigger sizes when the supply of public housing increased significantly. But it will take at least four to five years to reverse the situation where public housing supply has lagged behind the supply of private housing.

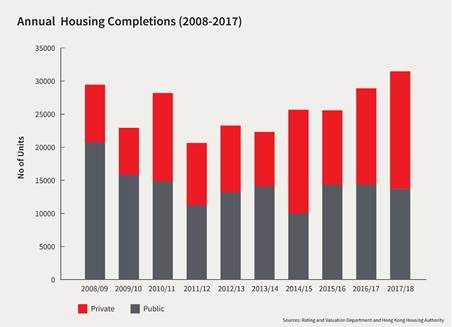

The Chief Executive has announced a proposal to adjust the target public-private housing ratio for land supply from 60:40 to 70:30. This was largely in response to the shortfall in public housing in previous years, with private housing completions exceeding public housing by 4,100 units last year. Government figures show that the shortfall was particularly serious in the financial year of 2014/15, with 61% of newly completed flats being private housing, while just 39% was public housing.

Henry Mok, Senior Director of Capital Market at JLL, said: “The increase in subsidised housing may sap some of the demand out of the lower end of the private housing market. It could affect the demand for nano-flats in more remote locations. As a response, we believe the developers will likely alter their projects to incorporate larger and more livable apartments with sizes range between 400 and 600 sq ft and two-bedrooms design, targeting middle class buyers. However, it still depends on whether the government would relax the restrictions on mortgage to ease the down payment burden on buyers.”

Cathie Chung, Senior Director of Research at JLL, said: “We believe that the announcement is an initiative in the right direction in solving the persistent housing problem for the city’s lower-income households. However, it will take at least four to five years to see the change in the public to private housing ratio to be realised in completions. Over the medium-term, private housing completions are likely to fall, especially in the luxury segment, which is also being affected by the recently proposed vacancy tax. A lower ratio for private residential development will only lead to a shrinkage in supply, supporting capital values.”

Visit JLL website for further details via www.jll.com.hk.