(22 February 2021, Hong Kong) The decline in office rental has abated in January with net effective rents in the overall market dipping by 0.6%, according to JLL’s latest Hong Kong Property Market Monitor released today.

The rental fall was moderate, compared with the overall drop in Grade-A office rents of 1.1% m-o-m in December last year. Office rents in core business districts, Central and Tsimshatsui, were relatively stable last month. However, Wanchai/Causeway Bay experienced the most significant rental contraction and fell 1.4% m-o-m.

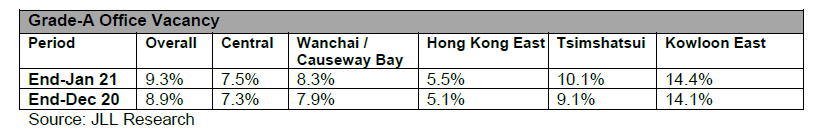

Central’s vacancy rate continued to increase, reaching 7.5% as of the end of January. Tenant decentralisation remained an ongoing trend as corporate tenants looked to cut rental expenses in the midst of recession and relocate to more cost-effective office locations.

Alex Barnes, Head of Office Leasing Advisory at JLL in Hong Kong, said: “The Grade-A office market recorded an overall net withdrawal of 366,200 sq ft in January as downsizing among occupiers remained in view. We believe Hong Kong will rebound quicker than most comparable markets because of its importance to the mainland China market. Although the total number of regional headquarters in Hong Kong decreased by 2.4% in 2020, companies from the U.S., mainland China and Italy rose 1.4%, 10.2% and 15% respectively. More mainland China firms set up a regional office in Hong Kong in 2020 compared to 2019. Hong Kong’s office leasing market will benefit from this in the long term,”

In the retail market, Nelson Wong, Head of Research at JLL in Greater China, said: “In view of the weak market conditions, street shop landlords are increasingly willing to soften asking rentals and be flexible on leasing terms. Consequently, some retailers took advantage of the tenant-favorable terms to open and expand.” China Construction Bank (Asia) has reportedly relocated to and expanded in Circle Plaza in Causeway Bay, committing to a four-storey shop size of 8,024 sq ft. The bank is currently renting a 4,098 sq ft shop at Causeway Bay Phase 1 at the same consideration.