Climate change is one of the greatest threats facing humanity today. Over a decade ago, the United Nations-backed Intergovernmental Panel on Climate Change (IPCC) confirmed greenhouse gas emissions from industrial activities lead to temperature increases, rising sea levels, and irreversible biodiversity loss. Buildings and construction are responsible for 38% of total carbon emissions globally, and with development floor area set to grow by 75% within the next 30 years, sector stakeholders must take action.

(按此瀏覽中文版)

The Paris Agreement was born out of the United Nations Climate Summit in 2015 and is the first ever legally binding international treaty on climate change, setting the framework for limiting global warming to well below 2°C and striving for 1.5°C. To define and promote best practice on reducing carbon emissions, the Science Based Targets Initiative (SBTi) was set up by a coalition of scientists and environmental groups. Further to promoting the “Paris-aligned” decarbonization pathway, SBTi also issued a ‘Corporate Net-Zero Standard’ which calls for halving emissions before 2030 and achieving net zero by 2050. As of July this year, 170 global real estate companies have committed to the SBTi – 10 of which are based in Hong Kong with most of them committed to a 1.5°C level decarbonization.

With close to 70% of total carbon emissions in Hong Kong coming from the built environment, the active participation of the city’s real estate owners, occupiers, and developers will be crucial in moving the city toward a net zero future. The Urban Land Institute (ULI) Hong Kong is proud to be a long-term partner of these groups, supporting their efforts to decarbonize and improve the resilience of Hong Kong’s real estate.

Mega typhoons, heat waves, and flooding in the region due to climate change pose direct threats not only to our buildings, but to our food supply, utilities, and transportation. To address these systemic risks, ULI Hong Kong set up a Resilience Working Group in 2022 to raise awareness and find a way forward. We held a webinar in May 2022 joined by experts from ARUP, the City University of Hong Kong, the University of Hong Kong, and startup Negawatt to define what ‘resilience’ means for the city. Our speakers explained the imminent climate threats to Hong Kong and the Greater Bay Area, outlining the methodologies being used to assess the risks. They also gave their insights on the innovative technology available to optimize building operations and improve the resilience of our local food system, as well as corporate responses to new mandates related to climate risk disclosure. In the future, the Working Group will explore these topics in more depth through expert sharing, site visits, and workshops.

Taking Climate Action through Industry Partnership

Companies and funds are increasingly expected to take responsibility for their ESG impacts, yet it takes significant time and resources to build a well-rounded ESG team that can master all areas of best practice from electrification to embodied carbon to workplace wellness. Furthermore, the latest IPCC report clearly indicates that we do not have the luxury of time for each company to “reinvent the wheel” on their decarbonization strategy. The speed of our transformation not only depends on the solutions available, but also on how well we collaborate across companies, sectors, and regions.

The ULI Randall Lewis Center for Sustainability in Real Estate is dedicated to creating healthy, resilient, and high-performance communities around the world. The center includes the Building Healthy Places Initiative, the Urban Resilience program, and the Greenprint Center for Building Performance. The center publishes numerous in-depth industry research every year, recent reports covered topics such as green buildings for healthier people, renewable energy strategies, climate migration and real estate investment decision-making, and global sustainability outlook.

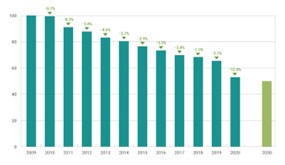

ULI Greenprint is a global membership consortium of real estate owners, investors and other partners committed to improving the environmental performance of the real estate industry. Greenprint members account for nearly 12,000 properties (US$1.3 Trillion in AUM), which are committed to achieving net zero carbon operations by 2050. With annual emissions reductions averaging over 3%, Greenprint member properties are on track to meet their interim goal of reducing emissions by 50% by 2030 (Figure 1).

The Greenprint program encourages portfolio-wide carbon reductions via energy-efficiency improvements, on-site renewable energy, green utility power and building electrification, off-site renewables, renewable energy credits and offsets. Its members aim to accelerate their decarbonization journey with focused knowledge sharing and public-private collaboration programs to finance, deploy and scale the best solutions in the shortest time possible.

For more information about our program of work or the benefits of ULI membership, please contact Jan Lee at [email protected].