Real estate investors adopt a wait-and-see approach in the short term due to US tariffs

HONG KONG, 24 April 2025 – Rents and capital values of almost all Hong Kong’s commercial and residential properties continued to fall in the first quarter of 2025, due to soft market demand and abundant supply, according to JLL’s latest Preliminary Market Summary (1Q25) released today. Only luxury residential recorded rental growth over the past three months. However, office and retail leasing activities, together with residential sales transactions, remained strong.

Cathie Chung, Senior Director of Research at JLL, said: “Tariffs will have an impact on the macroeconomic landscape, but the magnitude will depend on how policy plays out. Any direct impact on Hong Kong’s real estate market remains uncertain as the situation continues to evolve. In the short term, factors such as the ongoing tariff issue and unclear interest rate trends are likely to prompt investors to adopt a cautious, wait-and-see approach towards property investments. The industrial and logistics sectors may face increased pressure during this period.”

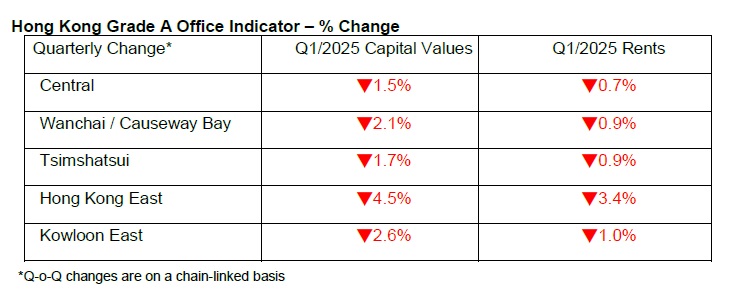

Office Market

Net absorption in the first quarter of 2025 was negative at 143,400 sq ft, primarily due to sizable spaces re-entering the market following previous consolidations and relocations. The overall office vacancy rate rose to 13.7% at the end of March . In particular, vacancy in Kowloon East rose from 18.6% in the fourth quarter of 2024 to 21.3%. Conversely, Central’s vacancy dropped to 11.5% from 11.6%, while vacancies in Wanchai/Causeway Bay and Tsimshatsui also improved to 9.5% and 8.3%, respectively.

Rents in the overall market declined by 1.3% q-o-q in the first quarter of 2025, with all submarkets registering declines. Rents in Central continued to drop by 0.7% q-o-q, while rentals in Hong Kong East registered the largest decline of 3.4%.

Sam Gourlay, Head of Office Leasing Advisory, Hong Kong Island at JLL, said: “The office leasing market in the first quarter of 2025 remained under the pressure due to abundant new supply, resulting in negative net take-up and rising vacancy rates. Whilst market sentiment showed signs of improvement, supported by notable financial occupier expansions in core locations, Grade A office rents are still expected to fall 5-10% this year.”

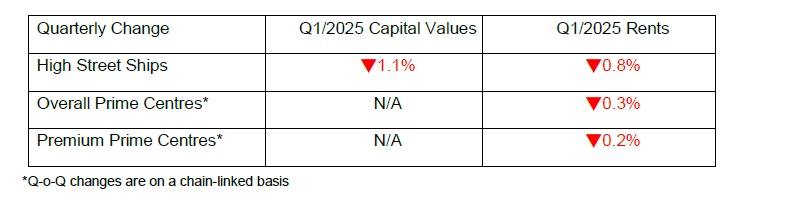

Retail Market

High street shops vacancy rates edged up slightly to 10.6% at the end of March from 10.5% at the end of 2024, while Prime shopping centres vacancy rate climbed to 9.2% from 9.1% last quarter.

Jeanette Chan, Senior Director of Retail at JLL in Hong Kong, said: “However, leasing momentum in core areas remained active, particularly in mass-market segments, fitness centres, and securities firms. Retail rents continued to dip as landlords in general offered discounts to attract and retain tenants amid sales headwinds. In the first quarter of 2025, rents slid by 0.8% q-o-q for High Street shops, and fell 0.3% and 0.2% for Overall Prime and Premium Prime shopping centres respectively.”

She expects rents of High Street shops and Prime shopping centres to decline by 0-5% this year.

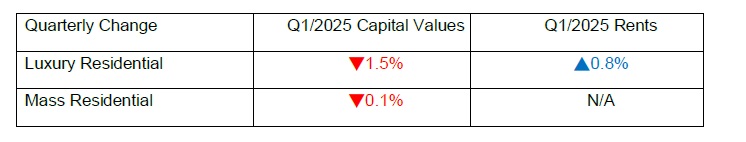

Residential Market

Mass residential capital values held steady in the first quarter of 2025, experiencing a marginal q-o-q decline of 0.1%.

In the first quarter of 2025, primary residential transactions totalled 3,897 units, while secondary transactions reached 8,296 units. The overall transaction volume reflects an overall q-o-q decline of 19.2%, yet marks a 24.1% y-o-y increase. However, the government raised the threshold for properties subject to a nominal stamp duty of HKD 100 from HKD 3 million to HKD 4 million. This measure will potentially stimulate demand in the entry-level residential market and support the price level in March.

In the first two months of 2025, approximately 14,200 talents entered Hong Kong through talent schemes, accompanied by 9,300 dependents. The inflow of non-local talents continues to support the demand in the luxury residential market, with rents rising by 0.8% q-o-q in the first quarter of 2025. Leasing transactions volume remained stable.

Joseph Tsang, Chairman of JLL in Hong Kong, said: “The US tariffs and the US-China trade war continue to evolve. The full impact may take time to become visible as economic effects materialise gradually and the situation unfolds. However, this situation may trigger a trend of RMB depreciation, potentially attracting mainland Chinese capital into Hong Kong’s residential market. We maintaine our previous market forecast, expecting capital values of mass and luxury residential to drop 5% this year.”

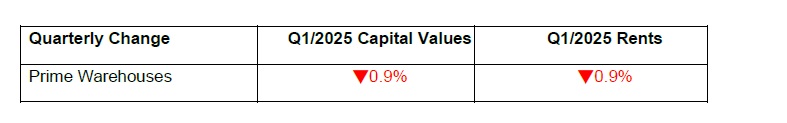

Industrial Market

The leasing market continued to be dominated by renewals, while the investment market was driven by multiple disposals from primary new modern industrial projects. The overall vacancy rate of warehouses rose to 8.9% in the first quarter of 2025 from 7.9% at the end of 2024. Prime warehouse rents dipped by 0.9% q-o-q in the fourth quarter of 2024.

Ricky Lau, Head of Industrial of JLL in Hong Kong, said: “The vacancy rate for prime warehouse, which remained below 2% during the pandemic, has risen to over 8% by the end of March. Given Hong Kong’s total prime warehouse stock of over 60 million sq ft, this has translated to more than 5 million sq ft of vacant space. In recent years, demand for prime warehouses from both trade-related business and domestic markets has weakened, due to the ongoing US-China trade tensions and a slowing global economy. Hence, the vacancy rate for premium warehouses is expected to rise further, suppressing the rental rates,”

“While it is too early to predict the impact of US tariffs on Hong Kong’s warehouse and industrial properties at this stage due to high level of uncertainties, it is clear that the structural changes in the global economy are prompting the related industries, such as Hong Kong’s import-export trade, to transform in the medium to long-term. This process of searching for new directions will take time and inevitably face challenges,” he added.