(26 May 2022, Hong Kong) The rapid development of China’s Top Five City Clusters (Greater Bay Area (GBA), Yangtze River Delta, Beijing-Tianjin-Hebei, Chengdu-Chongqing and the middle reaches of the Yangtze River) over the last 10 years has led the country’s fortune, population and consumption power to be concentrated in these five clusters. This will boost the development and demand for office and retail space in the clusters and bring more investment opportunities for alternative real estate such as industrial park, long-term leasing apartment and elderly homes. Data centres and industrial properties in the nearby cities would also attract the investment interests, according to JLL’s latest China 5: From World City to World City Cluster whitepaper released today.

With the support of government policy, the five clusters are well-connected with efficient transport networks. The transportation network in the GBA is the most mature among the clusters and has led to the development of the one-hour living circle model which has facilitated collaboration between the cities in the area. The development plan of 9+2 cities in the GBA is also unique among the clusters and enables the GBA to play a greater role in the financial market. Hong Kong’s two-way leading role will facilitate capital circulation between mainland cities and Hong Kong and provide funding for the expansion of new economy, innovation and technology firms with many Hong Kong companies recently investing in the area of cross-border finance and professional qualification recognition.

Shenzhen, which has 32 unicorns and accounts for over 60% of unicorns in the GBA, is leading the development of the area with its innovation industry. Over 40% of new startups are based in the GBA, while over 10% are from Shenzhen. Shenzhen and Guangzhou have more than 18,000 and 11,000 high-tech enterprises, respectively, a leading level in China.

Recruitment data from Zhaopin, a mainland recruitment website, showed the population influx in the GBA reached 14.7% in 2021, ranking second in China’s major city clusters after the Yangtze River Delta. The total population of the nine cities in the area has reached 78.01 million, 40% more than 10 years ago, with the population growth higher than the average growth rate of 5.28%.

Nelson Wong, Head of Research at JLL in Greater China, said: “One of the important growth drivers for the Greater Bay Area is the accelerated integration of Hong Kong into the Mainland. Closer collaboration enabled by more efficient flows in talent, capital, goods and information will undoubtedly create synergies and lift the overall growth potential of the region. We expect Hong Kong to enter into a new phase of development led by the research-oriented, technology-based industry, notably in the proposed Northern Metropolis. The globally renowned research capabilities pioneered by the myriads of tertiary research institutions in Hong Kong will be able to better leverage on the well-established technology eco-system in Shenzhen, thereby helping to apply and commercialize their innovations and discoveries.

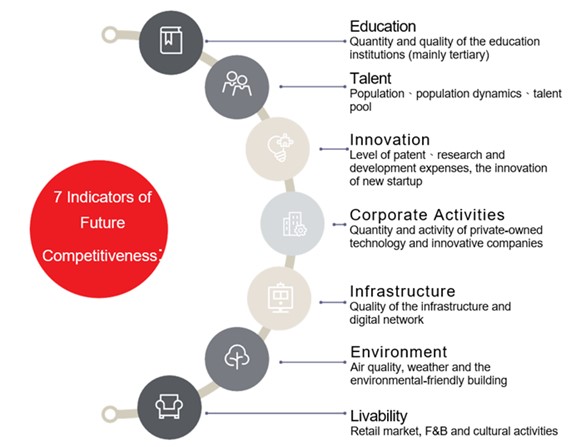

New indicators of future competitiveness JLL has identified new indicators to measure the future competitiveness of the clusters. The indicators included education, talent, innovation, corporate activities, infrastructure, environment and livability. This helped to identify the strengths of the five major clusters.

- Yangtze River Delta: accounts for 20% of China’s total GDP and is the key driver for the country’s economic development. Its technology and innovation capability plays a leading role in China. Electronics, automobiles and new finance are the core industries in the area, which aims to become a globally leading innovation hub and the key modern services and advanced manufacturing centre in the world.

- Greater Bay Area: one of the areas in China with the most international exposure and the most economic energy. The area has formed a modern industrial system focused on new finance, logistics and smart manufacturing driven by technology and innovation.

- Beijing-Tianjin-Hebei is positioned as a World-class city hub led by the capital city of Beijing. It has achieved breakthroughs in transportation and environmental sustainability. The quality of the corporate activities and innovation index rank top in China.

- Benefited from the initiatives of “One Belt, One Road” and the new Western land-sea corridor, the Chengdu-Chongqing city hub plays an important role in the development of the hinterland and western China. The sustainable development of the city hub will be driven by the financial and technology industries. The city hub also benefits from high consumption power which drives economic growth as a result.

- The middle reaches of the Yangtze River are well-connected with the other mainland cities and the area is one of the most dynamic and the core growth pole city cluster in China which is mainly driven by the manufacturing industry. With the advantage of quality tertiary education and a livable environment, the city hub continues to attract talents. About 44% of the population are millennials, which helps to inject new vitality into the city.

Bessie Lee, CEO at JLL in Greater China, said: “Under the new landscape of collaboration between the city clusters, it will be a common choice and major trend for tenants and investors to strategically invest in these clusters. The investment opportunities for commercial properties in the major five clusters will increase significantly. We will see more diversified opportunities and a forward-looking investment strategy will bring diversified benefits to the companies and investors.”

Diversified investment in core and satellite cities

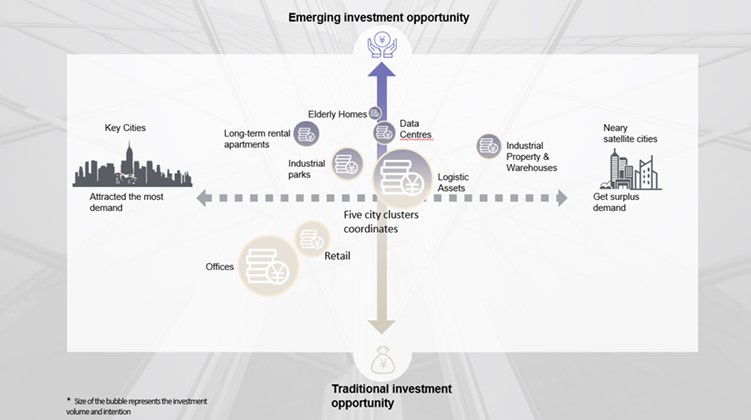

In the new development landscape of city clusters, the commercial real estate market of the five clusters is full of diversified investment opportunities. JLL has established a model of leasing trends and forecasted the investment outlook of various commercial properties in the clusters.

“The development of the five city clusters will support the office and retail properties market, and also create investment opportunity for new real estate assets such as industrial park, long-term rental apartments and elderly homes. The nearby cities of the city clusters will absorb the surplus demand, while logistic properties will also stand to benefit. Investors will eye industrial properties, data centres and elderly homes. Following the demand for various kinds of real estate, the development of the clusters will diversify the investment opportunities for commercial properties,” said Daniel Yao, Head of Research at JLL in China.