(11 July 2023, Hong Kong) Hong Kong’s retail market picked up notably after the borders reopened early this year. However, rising interest rates and the slowdown in the recovery of both the mainland Chinese and global economies continued to weigh on other property sectors, in particular residential, investment and land markets.

Cathie Chung, Senior Director of Research at JLL, said: “The worst situation is behind us. But the road to recovery is expected to be prolonged as there are five key factors affecting the pace of recovery: interest rate hikes, talent pool shrinkage, government policy, local economic growth and the pace of mainland China’s recovery. We expect the leasing and investment volume of commercial properties in the second half of 2023 would be higher than that in the last six months. However, we anticipate frequent fluctuations in rent and price levels and divergent performance among submarkets until the market regains confidence.”

Office Market

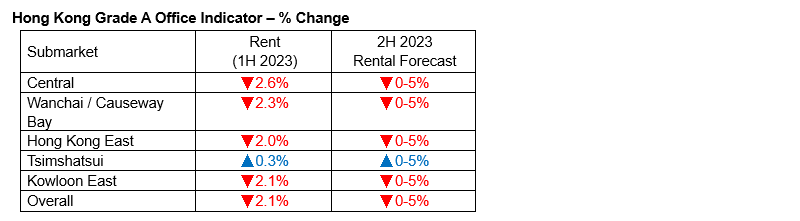

The total office leasing volume increased by 13.8% in the first half of 2023 after the borders reopened, representing 73% of the pre-COVID level at the end of 2019. However, the market recorded a negative absorption of 326,000 sq ft during the period, mainly due to the return of some sizable spaces. The overall vacancy rate rose to 12.6% by the end of June from 12.2% at the end of last year.

Asset management, private banks, funds and financial services remain the key drivers of office demand in Central, while business centres, financial services, consumer goods and insurance are active in Wanchai / Causeway Bay and Hong Kong East. Kowloon East mainly attracts professional services and technology occupiers.

Overall office rents declined 2.1% in the first half of this year, while Central’s rents dropped 2.6%. Tsimshatsui, on the other hand, recorded rental growth of 0.3% due to limited premium office space.

Paul Yien, Executive Director of Office Leasing Advisory at JLL, said: “As for the market outlook, the government’s various talent schemes will further support office leasing demand. Consolidation and upgrading activities will continue to support leasing demand in the coming six months. Tenants are more willing to make real estate decisions as office rents are around 30% lower than the market peak in 2019 and landlords are more flexible with leasing terms. Despite the vacancy rate likely edging higher due to the new office supply, we expect the overall office market to further stablise in the next six months, with rents to edge down modestly by 0-5%.”

Retail Market

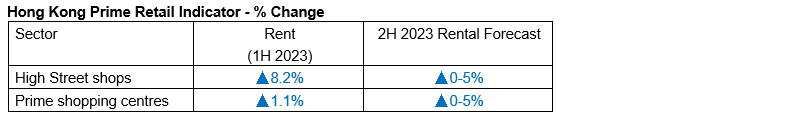

The retail market has been the biggest beneficiary of the re-opening of borders. Total retail sales recorded a 21.0% y-o-y growth in the first five months of this year. Leasing momentum has picked up and leasing activity accelerates, particularly in core shopping districts, bringing High Street shops vacancy rate down from 16.6% at the end of last December to 13.7% at the end of June. Rents of High Street shops rebounded 8.2% in the first half of 2023 after falling 10.6% last year.

Leasing activities continue to be dominated by the mid-to-mass-end trades and F&B segments, with the return of some luxury and high-end brands to the market. F&B, grocery, mass fashion and lifestyle trades as well as experiential retail are expected to support leasing demand in the near term.

Oliver Tong, Head of Retail at JLL, said: “About 4 million sq ft of new retail supply is scheduled for completion by the end of the year. All of these projects are located in non-core shopping areas. While the abundant new supply could translate into some vacancy pressure to shopping centres, it is high time that landlords should adopt flexible leasing strategies to boost pre-commitment and establish competitive edges to attract shoppers by enriching tenant mix and by repositioning,”

In the meantime, another challenge for the retail market is the leakage of domestic spending driven by rising outbound travel, which could decelerate retail sales growth. The depreciation of RMB could potentially induce more Hong Kong residents to visit mainland China and discourage inbound visitation from mainland China.

Oliver expects the rents of High Street shops and Prime shopping centres will rise by up to 5% in the second half of this year.

Capital Markets

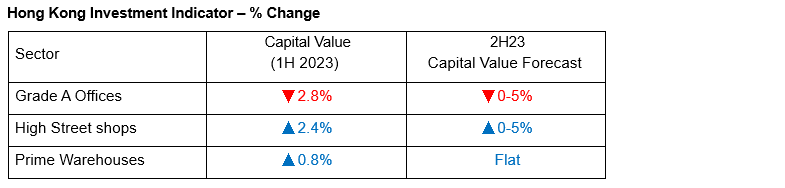

With the heightened financing cost, investors were conservative towards property investment. Total investment volumes of commercial properties valued at HKD 50 million or above dropped by 1.8% from the previous six months to HKD 17.8 billion in the first half of this year.

Benefitting from the border reopening and rental recovery, the transaction volume of retail properties saw a mild pick-up while the rest of the commercial sectors shrunk. Sales of retail properties accounted for about 43.5% of the total commercial property investment, of which investors regained their appetite for High Street retail shops, driving the capital value of High Street shops to rebound by 2.4% after it dropped 7.6% last year.

Moving forward into the second half of 2023, retail properties will continue to attract investors. Oscar Chan, Head of Capital Markets at JLL, highlighted that alternative investments such as senior housing and talent housing will also attract the investors’ interests.

“Talent housing will arise on the back of the government’s initiatives to attract more talent to Hong Kong. The format of talent housing would be similar to the co-living setting,” he added.

He expects the total investment volume to improve in the second half of this year as the market is likely to see more distressed properties being listed at a lower price by the owners who are in urgent need of cash flows.

Residential Market

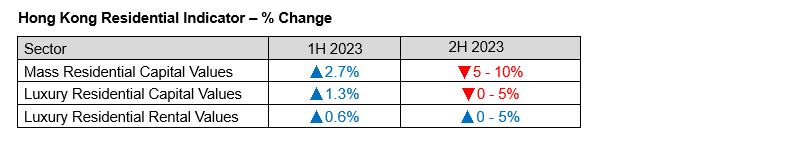

Mass residential capital values fell by 1.2% q-o-q in the second quarter of 2023 after it rebounded by 4.0% in the first quarter, in light of rising mortgage rates, ample new housing supply and the absence of mainland Chinese buyers.

Capital values of luxury residential climbed by 1.3% over the last six months, but the transaction volume for properties valued at or above HKD 20 million surged by 96.6% in the first half of 2023 as the pent-up demand released and new supply increased.

Joseph Tsang, Chairman at JLL in Hong Kong, said: “Hong Kong housing market is now having the longest price adjustment since 2008 and the market has not found a bottom,”

The overall home prices experienced a maximum decline of 15.9% from the peak over the last 20 months. It is noteworthy that the current cycle indicators are not favourable to the housing market recovery. The rising interest rates, volatile stock market, the challenging external economic environment and decreasing new births and marriages affected the housing demand. Meanwhile, the weaker-than-expected economic recovery in mainland China brought limited spillover effect to the housing market.

“Based on observations from previous cycles, current conditions do not warrant a sustainable home price recovery. Given the headwinds surrounding the sector, such as the challenging external environment and looming risks in the financial market, the current down cycle will be longer than previous troughs. The government should remove the cooling measures, in particular the measures on stamp duties and remove the mortgage stress test to give flexibility to the banks to assess the mortgage loan risk. The government should also prioritise the development of public housing and refine the policies on HOS secondary market,” he added.

For the market outlook, he believes the rising mortgage rates will continue to depress the residential sales market. Population inflow from mainland China will give more support to the residential leasing market. He expects capital values of mass residential will drop 5 to 10% in the second half of 2023, while prices of luxury units will drop up to 5%.

Land Market

Several government sites were sold at lower-than-expected prices or withdrawn from the public tender in the financial year 2022/23, resulting in a significant contraction of the revenue from public land sale and land premium for land-use conversion. The portion of land revenue dropped to 11.3% in the financial year of 2022/23, compared to 20.6% in the previous fiscal year.

The unsatisfactory results in land sales also triggered another concern about the standard rates for land-use conversion. Earlier in 2021, the government introduced standard rates to assess land premiums for lease modification and land exchange. Yet, the standard rates still remain at high levels in 2021 (except for Kwu Tung North and Fanling North New Development Area) despite the substantial drop in land prices over the previous quarters.

For example, a Kai Tak residential site was sold for an accommodation value of HKD 6,138 per sq ft at the end of 2022, back to the price level in 2014. However, the standard rate for a residential site in Kowloon East after lease modification is set as HKD 9,290 per sq ft, which is about 51.4% higher than the latest Kai Tak residential site sold. The price gaps will discourage the adoption of the standard rate scheme, which will defeat the purpose of the government to expedite the completion of lease modification or land exchange procedures through the introduction of standard rates.

Alkan Au, Senior Director of Value and Risk Advisory at JLL, said: “The shrinkage of both land sale and land premium revenue would lead to a significant contraction in total revenue, meaning less funding are available to afford the rising construction cost of major infrastructure projects. The expected completion of the transportation infrastructures, which are keys to the mega developments such as the Northern Metropolis and the Kau Yi Chau Artificial Island, could be adversely affected. Any delay in the completion of the transportation infrastructure projects is likely to dampen private investors’ confidence, making it more difficult for the government to push forward the development projects with limited participation of private developers. Therefore, the government should review the standard rates of land premium on regular basis with reference to the public land sale performance to ensure the pricing in both public and private markets are aligned.”