Hong Kong and overseas investors continue to increase stake in China’s property market despite volatility in domestic bourses and the weakening RMB

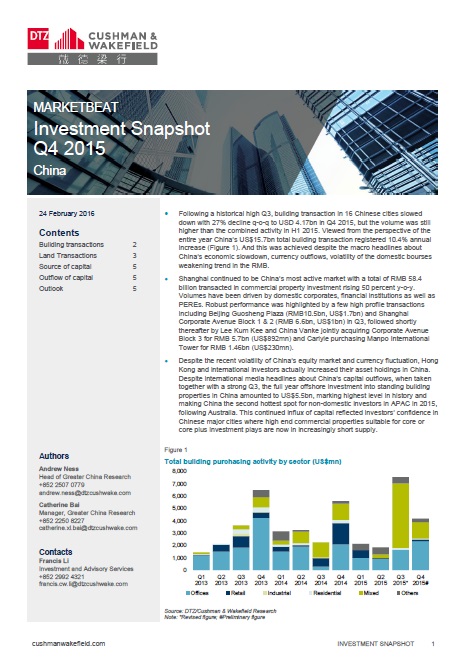

(29 February 2016, Hong Kong) – DTZ/Cushman & Wakefield, a global leader in commercial real estate services, published its latest Investment Snapshot China report today which reviewed the China property investment market in the final quarter of 2015. Following a historical high Q3, building transactions in 16 Chinese cities slowed down with 45% decline quarter-on-quarter to RMB26.6 billion (US$4.2 billion) in Q4 2015, but the volume was still higher than the combined activity in H1 2015.

Viewed from the perspective of the entire year, China’s RMB100.2 billion (US$15.7 billion) total building transaction registered 10.4% annual increase. This was achieved despite the macro headlines about China’s economic slowdown, currency outflows, volatility of the domestic bourses weakening trend in the Renminbi.

Shanghai continued to be China’s most active market with a total of RMB58.4 billion transacted in commercial property investment rising 50% year-on-year. Volumes have been driven by domestic corporates, financial institutions as well as private equity real estate firms (PEREs).

Hong Kong capital was active in the China investment market in standing commercial buildings and was involved in the top three transactions in Q4. Apart from Lee Kum Kee teaming up with China Vanke to acquire Corporate Avenue Tower III for RMB5.7 billion, Hong Kong based ARA acquired the Bank of East Asia Building for RMB3 billion, marking the second largest standing building transaction of the quarter. In addition, PAG was involved in the acquisition of Ciros Plaza for RMB2.9 billion. All three properties are located in Shanghai.

The full year offshore investment into standing building properties in China amounted to RMB34.8 billion (US$5.5 billion), marking the highest level in history and making China the second hottest spot for non-domestic investors in Asia Pacific in 2015, following Australia.

Andrew Ness, Head of Research, Greater China at DTZ/Cushman & Wakefield, commented, “Right now, the major theme for overseas funds is ‘flight to quality.’ Shanghai will continue to be China’s most active market, and the city has strong pipeline of deals going forward in 2016. There is a very clear trend towards trying to do core plus investment in Tier I cities. Flavor remains acquiring commercial assets. Main strategies being used are core plus and repositioning or value add. Looking towards the future, we would expect that amongst the Tier I markets Beijing, Shenzhen and Guangzhou markets to be somewhat more driven by corporate occupational investment as well as increasing diversity of asset classes traded as well as the types of investors engaged in deals.”

Although the influx of capital is expected to continue in 2016, which is in effect a vote of confidence in the economic resilience of China’s major cities, Andrew Ness said that commercial property suitable for core or core plus investment plays is increasingly in short supply. “Overseas players face increasing difficulty doing core plus in Tier I cities generally, because of the weight of capital brought to bear by domestic corporates, institutions and PE funds is large, and growing larger, as income producing commercial real estate appears to be an increasingly attractive safe haven for investment funds in China. Hence, value add opportunities have become harder to come by, over the past year and situation will further tighten going forward. Opportunistic investment is a strategy which is more suitable for Tier II cities, but Tier II cities plays are more suitable for specialized domestic investors, who are more sensitive to local market conditions,” said Andrew Ness.

On the other hand, domestic investment into the property market amounted to US$154 billion in 2015 (including both land and buildings transactions). Breaking down, domestic investment mostly fell in land transactions (US$143.8 billion), with US$10.17 billion being spent on building transactions. This gave the domestic investors a share of 96% of the total volume of major transactions in the property investment market last year.

Under new laws that were initiated in 2014, China decided to re-open the domestic debt bond market to developers. This is already having a huge impact on cost chain for larger developers, whose access to funding will remain healthy, due to benign onshore lending conditions. Domestic liquidity is more than sufficient to support new domestic developer’s bond market, and will remain open in 2016 as the domestic development industry is still on the path to recovery. Andrew Ness said, “As a consequence of abundant liquidity in China, we do not expect any shortages of fund availability in the commercial investment market as domestic corporate buyers, private equity funds and institutional investors and high-net-worth individuals will remain quite active.”