(13 December 2022, Hong Kong) The recovery of Hong Kong’s property market remained stagnant in 2022 with the downward trend across all property sectors except prime warehouses, according to JLL’s Year-End Property Market Review and Forecast released today. But Hong Kong’s commercial leasing and investment markets are expected to see improvements in the second half of 2023 if the latest gradual ease of Covid-19 restrictions in mainland China and Hong Kong continues.

On the contrary, for housing and land markets which entered a downcycle this year, 2023 will represent another challenging year as cooling measures remain.

Office Market

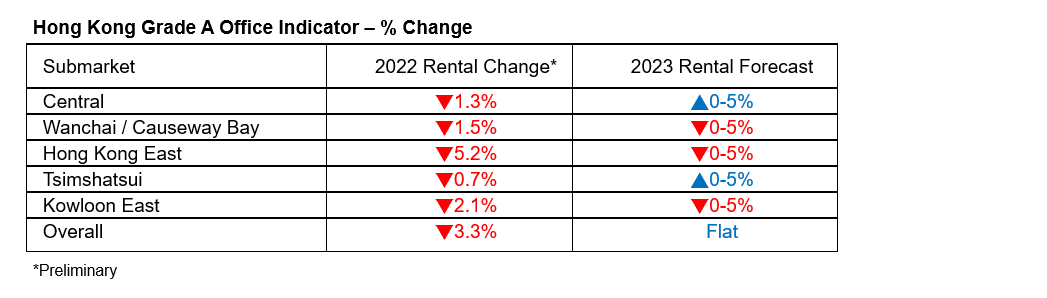

Office leasing activities were limited in the second half of 2022 as economic uncertainties weighed on the uptake. The overall vacancy rate rose to 11.6% at the end of November from 9.4% at the end of December last year. But the overall Grade A office rents remained relatively stable and only declined marginally by 3.3% in the first 11 months of this year.

The overall net absorption reached 2.0 million sq ft between January and November. Leasing activities continued to be driven by relocation and upgrading demand. Funds, private banks and asset managers continued to look at headcount growth in Hong Kong and upgrade opportunities for their workplace to support the needs of a tight talent market. Flex space operators continued to take advantage of favourable market conditions to expand their footprint in the city.

Sam Gourlay, Senior Director, of Office Leasing Advisory at JLL in Hong Kong, said: “Looking ahead, we expect to see a recovery in demand when Hong Kong fully reopens in 2023, in particular in the second half of next year. The gradual easing of Covid-19 restrictions in mainland China and Hong Kong, and pathway to more efficient overseas travel for Hong Kong, will lead to increased PRC and international demand. Other positive influencers include the near-term potential of “Insurance Connect”, as well as the growing biotech and life sciences sectors. The office market will record a positive net absorption, driven by tenants who look for high quality and newer office space for their talent.” The vacancy rate is expected to edge higher as the new office supply will reach 3.0 million sq ft next year. But Sam expects overall office rents to flatten next year. The emergence of new supply will keep some submarkets facing rental pressure.

Retail Market

Retail sales growth stalled in the second half of 2022, with domestic consumption being the predominant contributor.

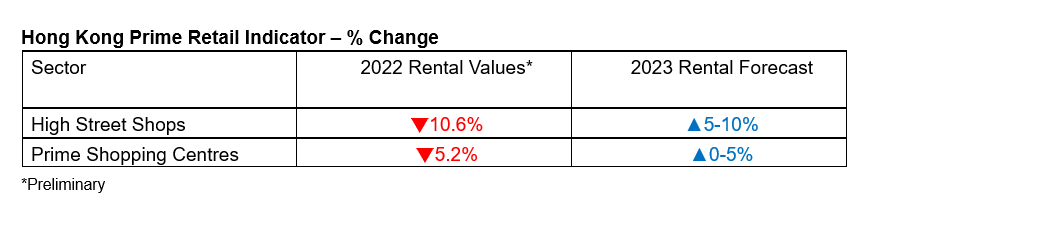

Rentals of high street shops dropped by 10.6% this year, and are at a level of 75.5% below the market peak in the third quarter of 2014. Rents of prime shopping malls fell by only 5.2% this year. Vacancy pressure in high street shops remained and has led the vacancy rate to grow further to 16.6% as inbound leisure tourists are yet to return.

In the second half of 2022, the gradual dissipation of the pandemic gave tenants the confidence to look for space in various districts. Leasing demand from F&B operators remained strong, while dispensary and drug stores began to return to the prime streets in recent months.

The sharp rental correction, strong local consumption power and the potential of the return of mainland Chinese tourists encouraged overseas retailers to expand in Hong Kong. The number of newcomers from overseas stayed firm this year. Jeannette Chan, Senior Director of Retail at JLL in Hong Kong, said: “The retail market will undergo a more visible recovery when inbound visitation for leisure purposes returns and the mainland China and Hong Kong border re-opens. It will support Hong Kong’s retail market if mainland China continues to relax Covid-19 and travel restrictions. We expect high street shop rents to rise 5-10% in 2023, while rents of prime shopping centres will climb 0-5%.”

Capital Market

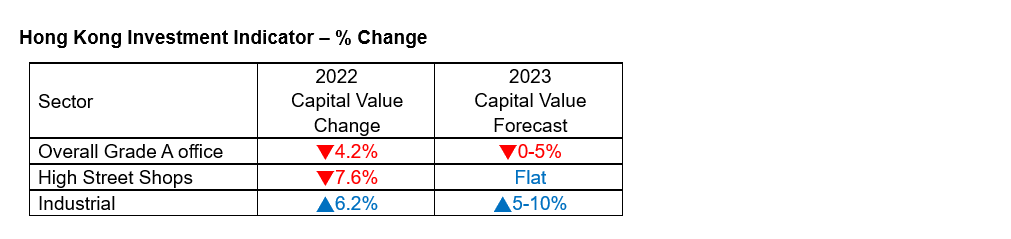

The unexpectedly aggressive interest rate hikes dampened interest in the commercial investment market. The total investment volumes of commercial properties sold for HKD 50 million or above dropped 75.4% y-o-y to HKD 11.5 billion in the second half of 2022.

Prime warehouses continued to outperform in the investment market, raising by 6.2% in its capital value; the only commercial sector that recorded capital value growth this year.

For the market outlook for 2023, Oscar Chan, Head of Capital Markets at JLL in Hong Kong, believes the industrial properties will continue to outperform the market and its capital value will rise 5% to 10% next year.

“Senior housing will be another focus for investors. They are looking for hotels to convert into senior housing with medical facilities as the average unit price of hotels is the lowest among all property types except industrial,” he added.

Residential Market

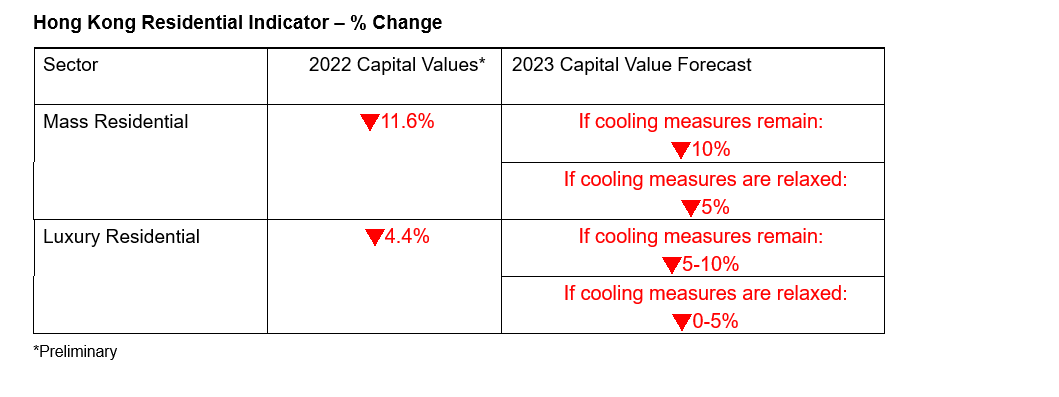

The rapid US rate hikes, the fifth wave of Covid-19 and weakened economic outlook have triggered the downturn in Hong Kong’s housing market. In 2022, mass residential capital values fell 11.6% by the end of November to the lowest level since March 2018, while luxury residential capital values dropped 4.4% due to weak local demand, absence of non-resident buyers and ample completions.

The total residential transaction volume and average monthly transaction in the first ten months have also dropped to 39,812 and 3,981 respectively, the lowest levels in 20 years. In the high-end residential market, the volume of residential sales valued at or above HKD 20 million dropped 65% y-o-y. The number of transactions also fell to the lowest level in nine years.

The weakening housing demand has led the unsold units of completed projects to surge over 63% to 14,700 in September. Developers began to delay the launches of new projects. Among units with presale consent approved in 2022, around 10,000 units were unsold as of end of October.

Joseph Tsang, Chairman of JLL in Hong Kong, said: “A high level of inventory will intensify the competition between developers in launching new projects. Developers will offer deeper discounts to boost sales. The first launched prices of recently launched projects are already 7% to 13% lower than the average price of secondary projects in the same precinct. But the rising mortgage rates will continue to deter the housing demand. If the cooling measures in the housing market remain, the trend of the market will rely on whether the full-scale reopening with Mainland China and overseas will give a boost to the local economy or not.” He expects the mass residential capital values will drop a further of about 10% in 2023, while luxury residential prices will fall 5 to 10%. However, mass residential prices will drop by only around 5% if the cooling measures are relaxed.

Land Market

Developers have turned cautious in land biddings due to the poor market sentiment in the housing market. The situation was even more obvious in the fourth quarter of 2022, with government sites sold at a level below or closer to the lower end of market expectations. But it is also a sign that the government is more realistic in setting a reserve price aligned with the latest market sentiment, which offers a good time for developers to build up their land bank.

Alkan Au, Senior Director of Valuation Advisory at JLL, said: “Developers will continue to be conservative in land bidding and land prices will continue to fall in 2023. The decline in land prices will be more than housing prices. The construction costs are still on an upward trajectory and will be fuelled by the looming inflation. The interest rate hikes have significantly increased financial costs, lowering the residual value reserved for the land price. The recent drop in housing prices worsens the case, and even with profit margin and cost remaining the same, the reserve for land cost will shrink further.”

The government has generated HKD 21.8 billion from land sales and lease

modifications/land exchanges as of today, reaching about 20% of the land income target for the current financial year. Considerations of lease modifications and land exchange dropped to HKD 26 million in the fourth quarter with no cases of lease modification recorded. The number of standard land premiums also fell from five cases in the last fiscal year to only two cases so far in the current financial year. “We estimated the government could generate an extra of HKD 35.5 billion from the tender of government sites, URA and MTR projects by the end of the current financial year in March. Including the previous land income, the government may not be able to achieve its land income target of HKD 120 billion due to the market downturn. Also, the current standard rate for land premium was set in 2021, which no longer reflects the market expectation in the prevailing condition. The government should review the current standard rate for the land premium to align with the latest situation,” he added.