(7 August 2023, Hong Kong) Cushman & Wakefield’s latest Asia REIT Market Insight report, for 2022-2023, reveals that overall, the Asia REIT market performed better than its U.S. and European counterparts in 2022, despite experiencing declines in stock prices and market values through the year.

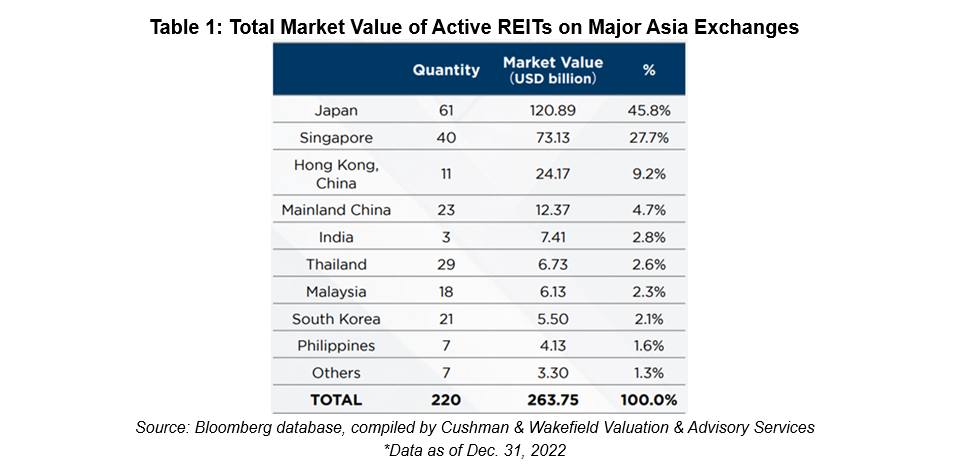

According to the report, the combined value of the Asia REIT market was at US$263.8 billion at the end of 2022, down 14.7% compared to the end of 2021. The mainland China REIT market value surged 80% on the back of new product offerings, although all other major Asia REIT markets experienced declines in market value.

Catherine Chen, Head of Capital Markets Research, Asia Pacific at Cushman & Wakefield, said, “The overall contraction seen in the Asia REIT market in 2022 was largely due to the influence of the U.S. interest rate hikes, coupled with the ongoing effects of the COVID-19 pandemic, which posed challenges for cyclical commercial real estate sectors such as office, retail, and hotel. However, these headwinds are becoming increasingly offset by growing market attention to new economy sectors, including modern logistics facilities and data centers, as well as living sectors, extending from multifamily assets to senior care facilities.”

While REIT products in Asia are still heavily concentrated in Japan, Singapore, and Hong Kong SAR, which together account for more than 80% of the market share, the mainland China REIT market climbed rapidly to rank as the fourth largest Asia market in 2022, up from seventh in 2021.

During the period the Asia REIT Market Insight report covers, from the end of March 2022 to the end of June 2023, a total of 17 new products were introduced into the China REIT market. The new entrants brought the total number of REITs listed in mainland China as of June 2023 to 28, including 16 real estate asset-based REITs with an average distribution yield of 4.2%.

Andrew Chan, Managing Director, Head of Valuation & Advisory Services, Greater China at Cushman & Wakefield, commented, “The new REIT products in China demonstrate development momentum across seven categories of underlying assets: industrial parks, warehousing and logistics facilities, industrial plants, affordable rental housing, highways, clean energy, and other environmental -related projects. In addition, as China’s public REITs pilot is now expanding to include the retail sector, we can expect the C-REIT market to diversify and further prosper, in turn helping to stimulate consumption and drive domestic demand.”

Please click here to download the report.