(19 May 2022, Hong Kong) The Grade A office market picked up some momentum in April due to the relaxed social distancing measures. Overall net absorption was 249,000 sq ft as tenant demand sustained in addition to the completion of new supply, according to JLL’s latest Hong Kong Property Market Monitor released today.

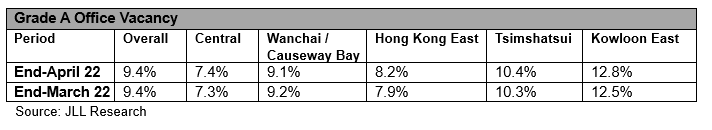

The overall vacancy rate stayed at 9.4% as of end-April due to the completion of the new supply. The vacancy rate in Central rose slightly to 7.4% while Kowloon East continued to register the highest vacancy rate among major office submarkets at 12.8%.

Overall net effective rents of Grade A offices remained flat in April. Among the major office submarkets, Central registered marginal rental growth of 0.1% m-o-m, while Tsimshatsui dropped 0.9% m-o-m, the highest rental decline among the submarkets.

Alex Barnes, Head of Agency Leasing at JLL in Hong Kong, said: “Hong Kong’s Grade A office leasing demand remained firm in the first quarter, despite significant work from home impact. More companies resumed their search for office space after the government relaxed the social distancing measures in April. We believe the market sentiment will continue to improve.” On the other hand, the retail leasing market continues to be negatively affected. Nelson Wong, Head of Research at JLL in Greater China, said: “Some retailers further postponed their expansion plans due to the unstable market situation, however, a handful took advantage of the limited bargain hunt opportunities and committed to new outlets. The investment market also picked up slightly in April, with a few sizable deals recorded. Notably, a ground-to-mezzanine floor shop (5,200 sq ft) at Yip Fung Building in Central was sold to private investor Douglas Young for HKD 165 million.”