(22 September 2016, Beijing) Urban Land Institute (ULI) has released Chinese Mainland Real Estate Markets 2016 today. According to the report, the Chinese mainland real estate made a strong recovery in the past year as a result of the government’s loose monetary policy and favorable policies for the housing market such as the cancellation of home purchase restrictions nationwide, except in the four Tier 1 cities. The current housing sector recovery has seen new home prices increase 8.9 percent on average across the Tier 1-3 cities in the survey for a 12-month period ending June, 2016. The four Tier 1 cities continue to occupy the top four places in the rankings for development and investment prospects, led by Shanghai at the top.

According to Kenneth Rhee, author of the report and the ULI Chief Representative for the Chinese Mainland, “Expansionary monetary policy as well as policies on home-purchase restrictions and down payment ratios clearly contributed to the housing market turnaround, but perhaps too drastically with some markets, including Shenzhen, Nanjing and Suzhou, overheating as a result. With the government already imposing restrictive policies to dial back the residential market, how the government further reacts will greatly affect the housing sector.”

HIGH SPEED RAIL DEVELOPMENT – AN INCREASINGLY IMPORTANT FACTOR

As predicted in the 2015 survey, China’s continued expansion of high-speed rail also accelerated the road to recovery for a growing number of Tier 2 and Tier 3 cities near major economic hubs such as the Yangtze River Delta. Kunshan and Suzhou are quickly evolving into suburbs of Shanghai, while cities near Beijing, Shenzhen, and Guangzhou are increasingly attracting homebuyers from nearby Tier 1 cities, with travel time reduced to less than one hour by high-speed rail.

According to the report, “Some interviewees even sounded guardedly optimistic about Yujiapu in the Binhai New Area of Tianjin, an often-mentioned symbol of China’s ghost city phenomenon, which is now connected to the traditional centers of Tianjin and Beijing via high-speed rail.”

Suzhou, Wuxi, and Hangzhou had the three largest improvements in the rating for investment prospects, while Dongguan, Shijiazhuang, and Hangzhou had the three largest improvements in the rating for development prospects.

OFFICE, RETAIL AND INDUSTRIAL REAL ESTATE SEE MIXED RECOVERY

OFFICE, RETAIL AND INDUSTRIAL REAL ESTATE SEE MIXED RECOVERY

While the residential sector is enjoying strong recovery, the results for office, retail and logistics sectors have been mixed.

The office markets in Tier 1 cities, including Beijing, Shanghai and Shenzen, remain generally healthy and continue to enjoy strong demand for office space driven by the information technology and finance sectors. Though some cities with strong IT industries such as Nanjing and Wuhan fare much better, most Tier 2 and Tier 3 cities, including Chengdu, Chongqing, Shenyang, Tianjin and Xi’an, continue to suffer from severe oversupply, compounded by slow economic growth for some cities.

Industry experts identify co-working space as a potential growth sector with a growing number of local developers and investors entering this niche sector and WeWork, the largest co-working space operator in the United States, recently entering the sector with its first office in Shanghai.

According to Rhee, “Dynamic economic growth in IT and finance, wealth accumulation, and demographic changes, including the new two-child policy, will create more opportunities for niche sectors such as senior housing, rental housing, and co-working space to take hold.”

The retail sector also continues to suffer from oversupply of existing and planned shopping centers in Tier 1-3 cities across the country. The growing e-commerce and ubiquitous use of smart phones has brought fundamental change to the tenant mix of shopping centers and total space required, with the share of merchandise retailers dropping to as low as 15 to 20 percent in some cases from the traditional 50 percent or more. The shift from offline to online has also impacted the way rent is collected, with landlords increasingly phasing out collecting a percentage of sales and instead only relying on base rent.

With regards to the logistics sector the level of enthusiasm has also decreased, with those surveyed identifying too much capital chasing investment opportunities and the difficulty of obtaining land, especially in Tier 1 cities. Despite the current slump, and land issue, some of those surveyed expressed optimism about future growth in the sector as they see an opportunity to address the current severe shortage of high-quality warehouse stock.

SHANGHAI MAINTAINS POSITON AS LEADING CHINESE CITY FOR INVESTMENT PROSPECTS

In light of mixed results across the different real estate sectors, industry experts rated the following cities in the top five for investment and development prospects in 2016:

1) Shanghai: China’s most populous city continued to be the most preferred city among survey respondents, who singled it out as “the only city in the Chinese mainland with liquidity for foreign investors”. Several investors also noted that even if the national economy slows down, Shanghai and other Tier 1 cities would fare relatively better than other cities. Notably, the average sales price for residential units rose more than 33 percent between June 2015 and June 2016.

2) Shenzhen: Although some interviewees excluded Shenzhen from their list of preferred cities to invest in, favoring instead Shanghai and Beijing, most credited the city’s IT and private equity sectors as the main drivers of the city’s real estate market. There is little doubt that Shenzhen has been the hottest real estate market in the Chinese mainland during the past year; the city’s average new home price increased over 47 percent during the 12 months ended in June 2016, the highest in the Chinese mainland.

3) Beijing: One of the most preferred markets for institutional investors; however, a number of industry experts complained of limited investment opportunities. According to one investor, Beijing has few tradable assets compared with Shanghai, and state-owned enterprises and IT companies tend not to be very price-sensitive when it comes to acquiring real estate properties, resulting in fewer opportunities for institutional real estate investors. With a robust demand from the IT and other service sectors, Beijing’s office market continues to perform well with the highest rent among the Tier 1 cities. Regarding the residential market, according to government data the average sales price of residential units increased over 22 percent since June 2015.

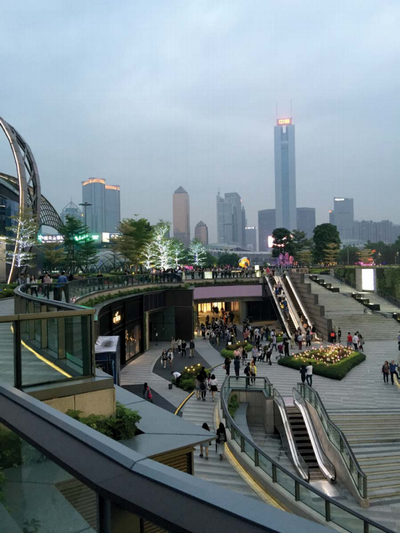

4) Guangzhou: Of the Tier 1 cities, Guangzhou has experienced the slowest rent and property increase. Also, it has not been an easy place for outside investors and developers, with the local market dominated by local developers who are generally considered capable and well-financed. The soft office market has been accredited to the limited presence of multinational company tenants and the slow growth of the IT industry, in addition to the expansion of office space in the adjacent city of Foshan. Foshan was also cited as a key reason for the relatively slow increase in Guangzhou’s home prices compared with the other Tier 1 cities, with the city’s average new home price increasing just under 20 percent since June 2015.

5) Suzhou: Replacing Nanjing as fifth, Suzhou’s ratings for investment and development prospects improved more than 12 and 9 percent, respectively, from 2015. One property analyst called Suzhou a suburb of Shanghai, highlighting the impact of the high-speed rail between the two cities. The travel time by high speed train between the traditional downtown of Suzhou and Shanghai Hongqiao Transportation Hub is less than 25 minutes.