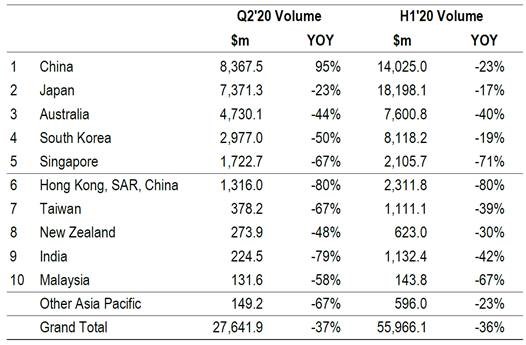

(19 August 2020, Singapore) A continuing appetite from cross-border investors for assets in the region and a robust Chinese economic recovery from the coronavirus pandemic shock were factors moderating the decline of just over a third in the volume of real estate investment transactions in Asia Pacific in Q2 2020, compared with Q2 2019, Real Capital Analytics’ latest Asia Pacific Capital Trends research report showed.

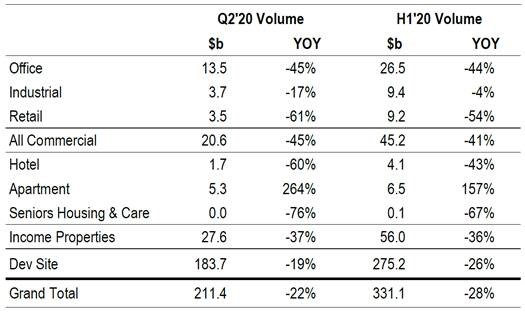

Total Asia Pacific deal volume was just under US$28 billion in Q2 2020, down 37% over the same period last year, and on par with the preceding quarter when the virus initially hammered the region’s economies. Sales of individual properties continued to weaken, falling to a 10-year low, as hopes of a V-shaped recovery across Asia Pacific proved short-lived, both in terms of the broader macroeconomy and commercial real estate markets.

David Green-Morgan, RCA’s Managing Director for Asia Pacific, said. “We saw real estate investment, in general, hold up much better in the bigger markets than secondary ones in Asia Pacific in Q2 2020. This was particularly true of China as extended lockdowns were limited in Beijing and Shanghai, the two cities that dominate property transactions nationally, but also in Japan and South Korea — where the headline numbers for completed deals don’t reflect the resilience of underlying activity on deals likely to close in H2 2020. Despite declining revenues in the hotel and retail sector as well as concerns over the future of CBD offices post-pandemic, there are as yet relatively few signs of distress in commercial landlords across Asia Pacific. Liquidity in markets is ebbing, but not in freefall, while investors with ample capital remain patiently on the side-lines. With government and commercial support for real estate occupiers thinning out in the coming months, we can expect rental payments to fall further, adding more pressure on sellers to reduce their pricing expectations.”

Cross-Border Investors Hold Firm as Domestic Investment Collapses, Retail and Hotels Crash

Cross-border investment in Asia Pacific grew 11% to US$13.2 billion in Q2 2020 compared with the same period of 2019. Almost half the capital deployed in the region originated from a global or intra-regional player, standing in stark contrast to a collapse in domestic investment activity. The numbers slightly overstate the strength of capital inflows, as volumes were boosted by a few billion-dollar deals which were agreed on before the pandemic rattled global markets in late March. Almost half the capital from outside Asia Pacific has gone to Japan this year, with multifamily assets the most popular sector.

For only the second time since 2007, trading volumes of industrial facilities in Asia Pacific outstripped those of retail shops and malls in a single quarter in Q2 2020. The relatively strong performance means that industrial volumes are down by only 4% over the first half of this year compared with the same period of 2019. In contrast, trading of beleaguered retail and hotel assets slumped by almost two-thirds year-on-year. An interesting niche property investment asset class that is rapidly gaining ground in Asia Pacific is data centres, on the back of the strong growth in demand for neutral co-location spaces in the region in the past few years. Confidence in the sector is high with expanding forwards sales being driven by buoyant pre-leasing demand.

No End in Sight for Hong Kong’s Retail Slump, but Price Falls Spark Investor Interest

The hard double-blows of street demonstrations and Covid-19 seem to have finally broken the will of Hong Kong’s besieged retail real estate owners in the city’s CBD, with a slide in asset prices now appearing to be sufficient in the second quarter to trigger the first uptick in transaction volumes since the pro-democracy protests started in May 2019. Retailers’ income streams have drained away in tandem with the inflows of mainland Chinese tourists over the past 12 months and owners are caving in and accepting significant price cuts for their assets. The pain is well distributed from the luxury boutiques in Central to high street retailers in Causeway Bay and Kowloon. Prime shop yields have moved out by 100 basis points in less than a year, but transaction volumes are still a far cry from what they were before the unrest began, and the fall in pricing may still have some way to go.

For further information, visit www.rcanalytics.com.