(28 August 2023, Hong Kong) Data centers across Asia Pacific are growing in scale and new markets are being evaluated for expansion as operators anticipate increased demand from continued digitization and wider adoption of artificial intelligence.

According to Cushman & Wakefield’s latest Asia Pacific Data Centre Update, mainland China retains its position as the dominant data center market in Asia Pacific, with the largest operational capacity at 3.8 gigawatts (GW), almost 40% of the regional total, followed by Japan at 1.1GW and Australia at 1.1GW.

Five cities — Beijing, Shanghai, Singapore, Sydney and Tokyo — account for 62% of the operational data center capacity in Asia Pacific, with Sydney and Tokyo expected to join Beijing and Shanghai in the next one to two years as cities exceeding 1GW of operational capacity.

The region’s primary markets, including Hong Kong, continue to experience growth despite challenges originating from a limited supply of land parcels and power availability. To help support the industry, the Hong Kong government has implemented initiatives such as the Data Centre Facilitation Unit (DCFU), which aims to attract significant investment, enhance infrastructure, facilitate industry collaboration, and ensure a conducive environment for data center operations.

John Siu, Managing Director, Hong Kong at Cushman & Wakefield, said: “Hong Kong is a robust data center market offering excellent regional and global connectivity, and availability of all major cloud networks. As a global financial and business capital, strategic location as a gateway to mainland China and for its globally lowest taxed data center jurisdiction, there has been strong demand from data center investors and operators that have triggered a high volume of transactions over the last few years.

“The tight land supply and waiting times for power supply are challenges to industry expansion. However, we forecast that more than 3 million sq ft of new data center space will be completed in the next three years, representing growth of 34% on current stock. We can expect this supply boost to further attract related technology companies and operators from both the mainland and from overseas to expand in Hong Kong.”

As a result of the supply challenges in primary markets, ancillary locations are also being evaluated as part of expansion strategies. Such emerging markets are now growing rapidly, with Indonesia, Malaysia, the Philippines and Thailand all on track to more than double [>200% increase] their operational capacity over the next five to seven years.

Pritesh Swamy, Director, Data Centers Research & Advisory for APAC and EMEA at Cushman & Wakefield, said that significant land banking in mature markets, coupled with growing data consumption, was leading operators to explore secondary markets.

“The potential capacity of land banks in some mature markets is more than the combined under-construction and planned pipelines. While it could take more than 10 years to develop these land banks, operators have started to explore other locations.”

He said cities with populations of over 1 million were often seen as strategic locations for smaller data centers.

“Smaller data centers can be used to cater for the local population or for operators to show their enterprise clients that they have a presence in strategic markets and growth corridors.”

The report also shows that the scale of individual data centers is increasing. Within the top five markets, the average size of data centers under construction is up 32% to 20MW, from an average size of 15MW for data centers currently in operation. Across the broader Asia Pacific region, the percentage difference is even higher, with the average size of data centers under construction (14.5MW) 57% higher than the average size of operational data centers (9.2MW).

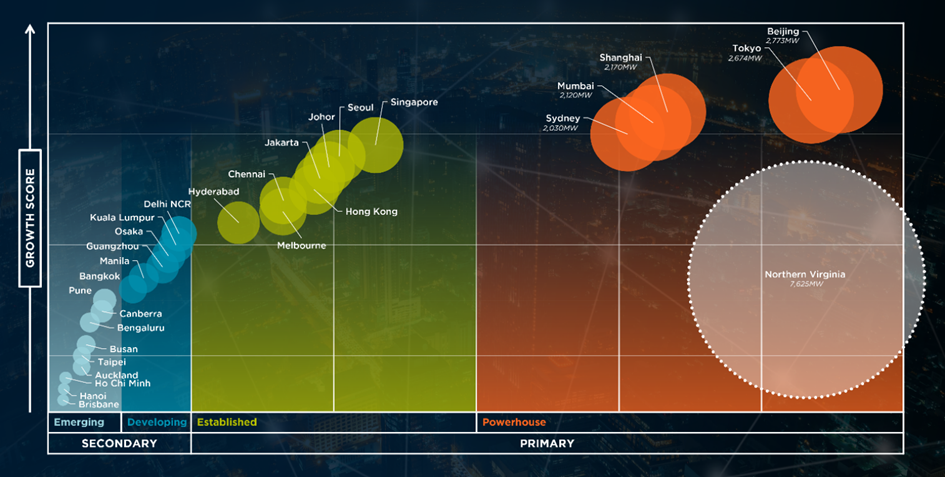

Maturity Index Extrapolates Growth Trajectories to Provide Future Insights

Supplementing the company’s global annual ranking of data center markets, which assesses data center markets on their current status, the latest Asia Pacific Data Centre Update also includes a Markets Maturity Index, which classifies 29 data center cities across four categories (Emerging, Developing, Established and Powerhouse), based on their anticipated evolution over the next five to seven years.

As an example of its application, the Maturity Index classifies Mumbai (which currently has 462MW in operation) ahead of Sydney (724MW) within the Powerhouse category after taking into account, among other factors, its under-construction pipeline of 342MW, which is the highest in APAC.

Beijing, Shanghai and Tokyo also make the Powerhouse category, with each of the five markets having the development pipeline to surpass 2GW in operational capacity over the next five to seven years.

Asia Pacific Markets Maturity Index

Please click here to download the full report.