(19 January 2023, Hong Kong) The overall Grade A office vacancy rate rose to 12.1% as of the end of last year due to new completions, according to JLL’s latest Hong Kong Property Market Monitor released today. However, JLL believes the reopening of mainland China’s borders will positively affect Hong Kong’s office market and the impact will be more visible in the second half of this year.

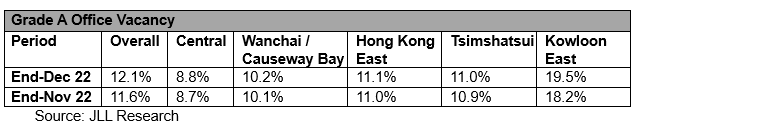

The overall net absorption of Grade A offices was -116,900 sq ft in December last year due to limited leasing activities towards the year-end. At the same time, new completions in non-core areas drove up the overall vacancy rate. The vacancy rate in Central and Wanchai/Causeway Bay rose marginally to 8.8% and 10.2% respectively, while Kowloon East’s vacancy rate rose to 19.5%.

Overall net effective rents dropped further by 0.4% m-o-m last month. Among the major office submarkets, rentals in Central and Wanchai/Causeway Bay both dropped by 0.5% and 0.4%, respectively. The overall market recorded a rental drop of 3.7% in 2022.

Alex Barnes, Managing Director at JLL in Hong Kong, said: “The re-opening of mainland China’s borders will positively affect Hong Kong’s economy. Most companies in the city will benefit from the growth this year. We expect to see an increase over time in companies from mainland China continuing to grow their operations or opening new offices in Hong Kong. We believe the impact of the reopening on the city’s office market would be more obvious in the second half of 2023.”

Nelson Wong, Executive Director of Research at JLL, said: “Leasing sentiment in the retail market remained soft in December last year and transactions in core areas were mainly short-term leases. However, Hong Kong’s retail market will see the most noticeable improvement among the property sector since mainland China has reopened its borders. The leasing activities in the retail market will rebound this year, and market interest in core areas is expected to return.”