(12 September 2017, Hong Kong) Knight Frank, the independent global property consultancy, today launches the Global House Price Index* for Q2 2017. The index monitors and compares the performance of mainstream residential markets in 55 countries across the world, 11 of which are from Asia-Pacific.

(中文简体版请按此)

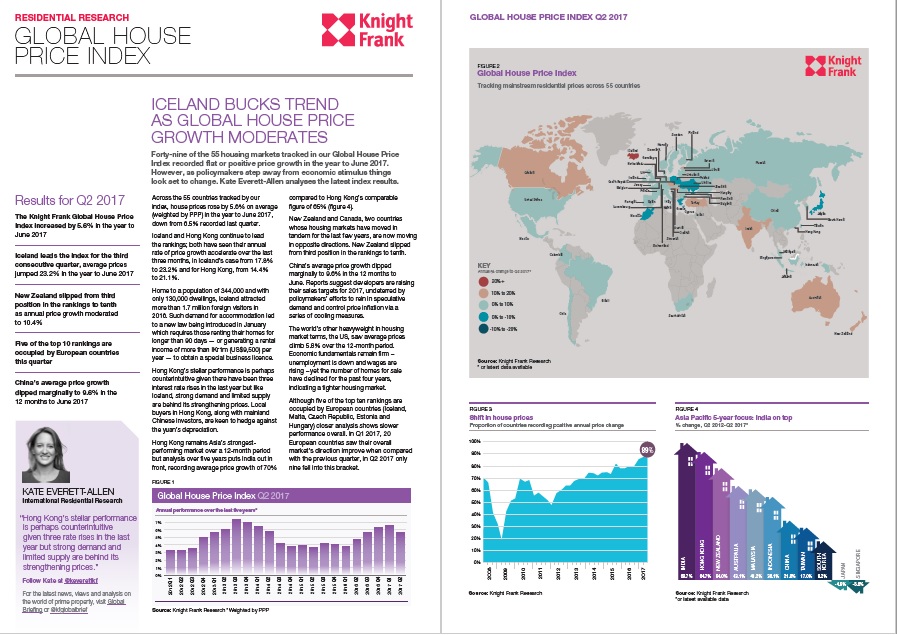

The index rose by 5.6% on average (weighted by PPP) in the year to June 2017, down from 6.5% recorded last quarter. Forty-nine of the 55 housing markets tracked recorded flat or positive price growth in the year to June 2017.

Results for Q2 2017:

- Iceland and Hong Kong continue to lead the rankings; both have seen their annual rate of price growth accelerate over the last three months, in Iceland’s case from 17.8% to 23.2% and for Hong Kong, from 14.4% to 21.1%.

- New Zealand and Canada, two countries whose housing markets have moved in tandem for the last few years, are now moving in opposite directions. New Zealand slipped from third position in the rankings to tenth as annual price growth moderated to 10.4%.

- China’s average price growth dipped marginally to 9.6% in the 12 months to June. Reports suggest developers are raising their sales targets for 2017, undeterred by policymakers’ efforts to rein in speculative demand and control price inflation via a series of cooling measures.

Nicholas Holt, Head of Research for Asia-Pacific, says, “The five-year price growth figures show a huge divergence in performance across the Asia-Pacific region, with the growth numbers in India (69.7%) standing in sharp contrast to Singapore (-5.6%) which has seen the stringent cooling measures applied over the period dampen market activity.

“The Australasian markets have seen some of the strongest growth over this period, with the cities of Sydney, Melbourne and Auckland especially outperforming the wider market.”

David Ji, Director and Head of Research & Consultancy, Greater China says another interest-rate hike is generally not expected during the remainder of the year. Hong Kong’s housing supply is expected to increase, but not in the short term. Given sustained demand, we expect prices to grow 10-13% for mass residential units over 2017.

* The index’s overall performance is weighted by GDP on a Purchasing Power Parity basis and the latest quarter’s data is provisional pending the release of all the countries’ results.

To download the report, please visit: