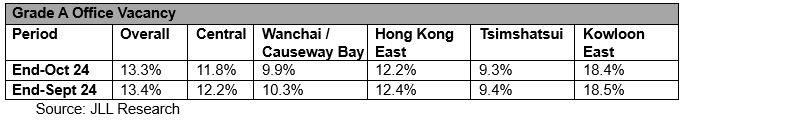

(20 November 2024, Hong Kong) The Grade A office leasing market showed improvement in October, with vacancy rates declining across all five major business districts, according to JLL’s latest Hong Kong Property Market Monitor released today.

As of the end of October, the overall vacancy rate fell to 13.3%. Notably, the vacancy rate in Wanchai/Causeway Bay decreased by 0.4 percentage points to below 10%, while the Central saw a similar decrease of 0.4 percentage points.

Alex Barnes, Managing Director at JLL in Hong Kong

Cathie Chung, Senior Director of Research at JLL

Alex Barnes, Managing Director at JLL in Hong Kong, said: “The overall leasing market also saw some improvement, recording positive net absorption of 183,700 sq ft last month. Financial institutions remain the most active tenants in the leasing market. We also see leasing requests from private wealth management firms and family offices. Despite the economic challenges, leasing demand from family offices is expected to increase in the long term, as the government has launched initiatives to attract high-net-worth individuals to set up family offices in the city.”

Millennium Management has notably leased an entire floor of 23,900 sq ft (LFA) at Two International Finance Centre in Central for in-house expansion. Meanwhile, Banco Santander, S.A. Hong Kong Branch has pre-committed to one floor of 27,200 sq ft (GFA) at the upcoming International Gateway Centre in West Kowloon, planning to relocate from Two International Finance Centre. However, Cathie Chung, Senior Director of Research at JLL, noted: “Despite improvements in vacancy rates, the overall net effective rent continued to decline, dropping by 0.8% on a month-on-month basis. Central experienced a further rent decrease of 0.8%, while rents in the Wanchai / Causeway Bay and Hong Kong East submarkets fell by 0.5% and 1.1%, respectively.”