(29 March 2023, Hong Kong) Knight Frank launches the latest Hong Kong Monthly Report. Hong Kong office market saw stronger activity in February as overall market sentiment improves in tandem with the revival of economic activity, Leasing sentiment in Kowloon has also gradually improved after the border re-opening. With local economic activity returning to normal, more developers rushed to launch new projects. The luxury market saw signs of Chinese mainland buyers returning after the border reopening. In the retail sector, Hong Kong’s top position as a luxury shopping destination for Chinese tourists has changed after the pandemic, so we expect retailers to adjust their sales strategies to focus more on affordable luxury goods to cater to growing demand from both locals and tourists.

Grade-A Office

Hong Kong Island

The Hong Kong office market saw stronger activity in February as market sentiment improves in tandem with the revival of economic activity. Despite the rental downtrend, the leasing market turned positive as the flight-to-quality trend continued. Companies from multiple sectors took advantage of the tenant-favoured environment to consolidate and upgrade their office space.

Increasing demand for small and medium-sized space continues to favour the co-working sector, which has fuelled the expansion momentum of co-working operators. A few operators took up sizeable areas in various locations. Leasing demand from Chinese mainland companies strengthened, but the number of transactions has yet to significantly increase.

Kowloon

Leasing sentiment has gradually improved after the border re-opening. The volume of new letting transactions in February doubled MoM. Kowloon East remains the focus of the market, with shipping, logistics and electronics companies the key demand drivers in January and February, followed by IT companies and co-working operators.

Demand from co-working operators also picked up, similar to the situation on Hong Kong Island. Certain co-working spaces in Kowloon reached high levels of occupancy of above 90%.

Overall, we expect office rents to move slightly upwards in the near term as demand from various sectors continues to provide momentum.

Residential

With the full reopening of the border with the Chinese mainland in early February, local economic activity and market sentiment saw a positive turnaround. According to the Land Registry, a total of 4,282 residential transactions were recorded in February, climbing 40.3% MoM. Primary sales supported overall market sentiment, surging 80.4% MoM to 655 transactions.

With local economic activity returning to normal, more developers rushed to launch new projects. The luxury market saw signs of Chinese mainland buyers returning after the border reopening. A handful of notable transactions worth HK$100 million or more were recorded, showing continued buyer appetite for prime assets.

Overall, the residential transaction volume is expected to gradually pick up with a sharp rebound in buyers’ confidence, but a full recovery is expected to take time.

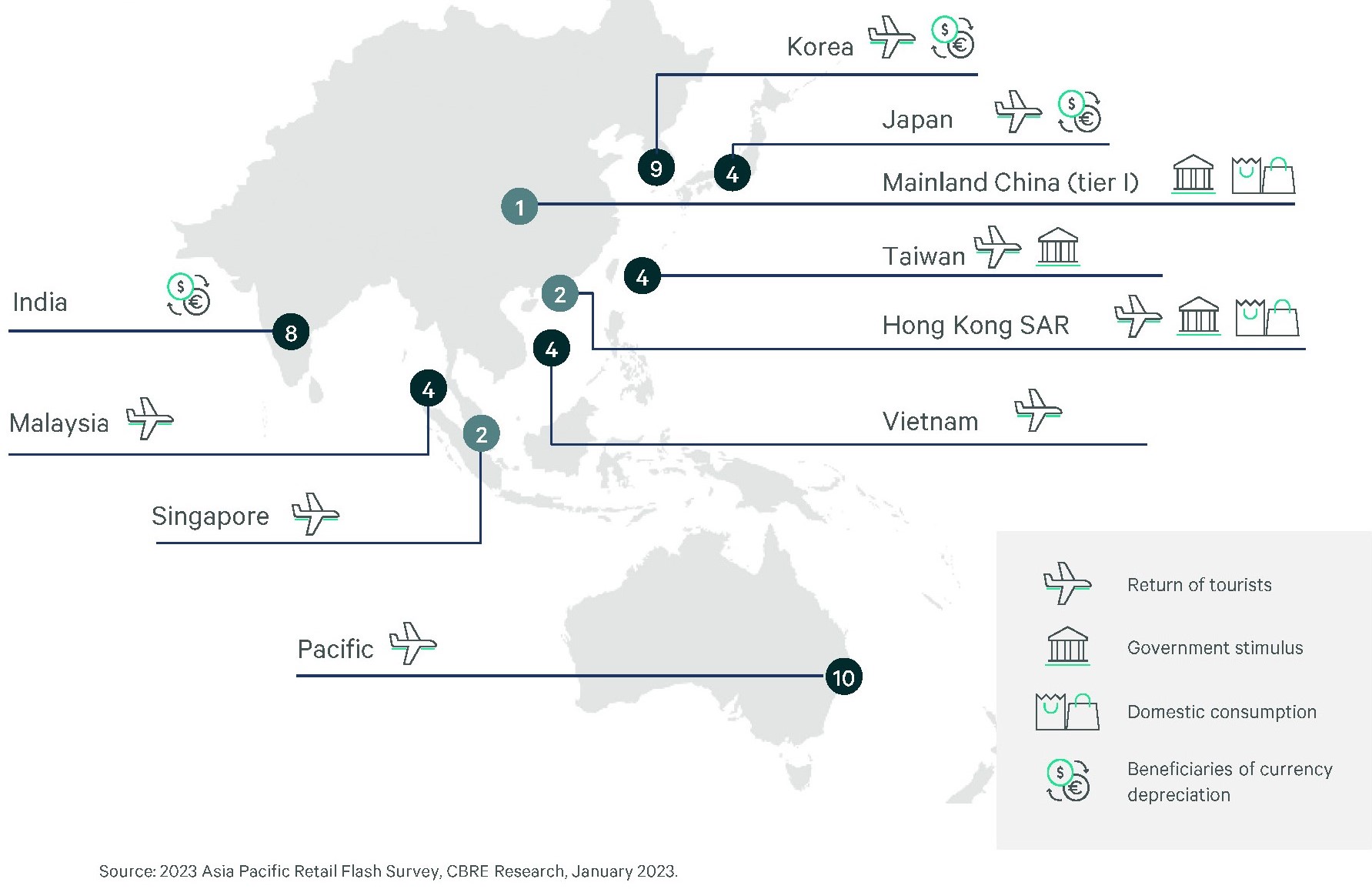

Retail

According to the latest official statistics, retail sales value in January increased by 7.0% YoY to HK$36.2 billion. Overall market sentiment turned positive, buoyed by the return of tourists. As travel resumed, the number of visitor arrivals in February rose threefold to 1.462 million from 498,689 in January. About 76% of visitors were from the Chinese mainland.

Backed by the encouraging rise in visitor arrivals and retail sales figures, tenants were more confident and willing to commit to large shops in core areas, evidenced by an increasing number of leasing transactions in prime shopping streets.

There is anecdotal evidence of a continuous rise in the number of Chinese mainland visitors coming to Hong Kong for casual shopping and dining at mid-range restaurants, but a drop in the number of visitors coming mainly for big-ticket luxury items. We believe Hong Kong’s top position as a luxury shopping destination for Chinese tourists has changed slightly after the pandemic, so we expect retailers to adjust their sales strategies to focus more on affordable luxury goods to cater to growing demand from both locals and tourists.

Looking ahead, the near-term outlook for retail sales remains sanguine, as consumer sentiment has been buttressed by favourable employment numbers, vibrant inbound tourism, and the removal of mask rules. Nonetheless, since retailers need time to adapt to the post-Covid era, we expect prime street rents to remain flat in the short term.

The report can be downloaded here.