(September 2020, Hong Kong) The downward trend continued in both the residential and investment markets in Q3 2020 as the pandemic and continuing geo-political uncertainties continued to weigh on sentiment. Despite the challenges, strong pent-up demand, government policy support, economic stimulus packages and the low interest rate environment remain favourable factors that, together, may stabilize the market and induce a rebound by the end of Q3.

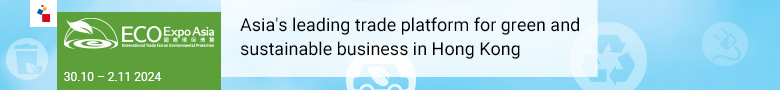

Residential transactions declined in Q3 by 6% quarter-on-quarter in both primary and secondary sales markets but recorded a major increase of 30% when compared with Q3 2019. While this indicates that social and economic factors continue to impact the residential market, the unprecedented owner-occupier demand and anticipation of a post-pandemic recovery can be strong stabilizers. Among individual estates, property prices at Taikoo Shing as of August had fallen their lowest level since January 2019 (Chart 1) while those in The Harbourside have fallen even further, and are now 10.6% below the previous trough in January 2019 (Chart 2). Prices of popular estates are expected to fall further in the near-term.

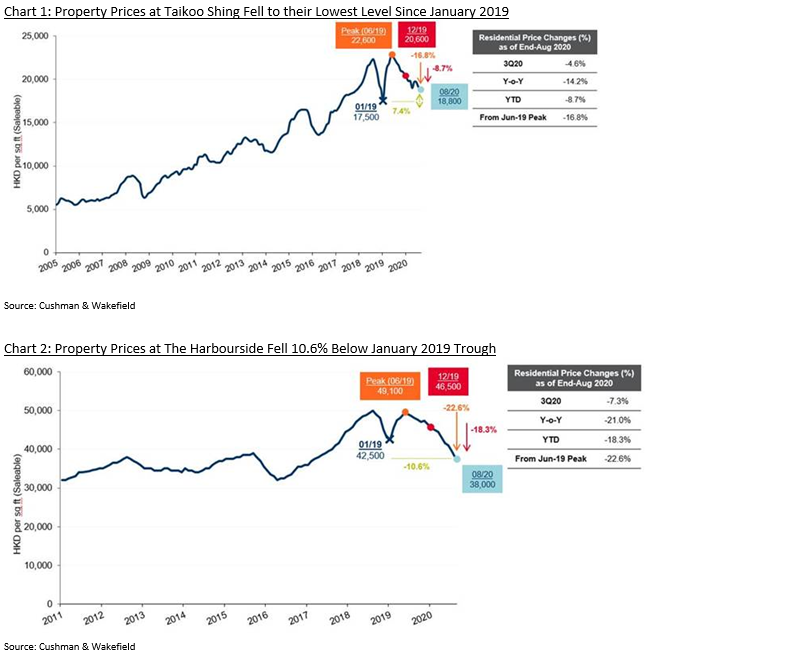

Mr Alva To, Cushman & Wakefield’s Vice President, Greater China & Head of Consulting, Greater China, commented “The secondary sales market has come under severe challenges from the pandemic blow. However, a recent decline in new cases coupled with strong pent-up demand may support a rebound by the end of September 2020. Nonetheless, from a more holistic perspective, with no lasting resolution to either the pandemic or geo-political challenges and with unemployment forecast to reach 7% by year-end, we expect home prices to remain under pressure and likely to conclude the year with an average drop of 10% among popular estates.” The investment market remained subdued in Q3 as local and foreign buyers remained on the sidelines. Year-to-date, a total of 32 major deals (each with a consideration of over HK$100 million) have been recorded (Chart 3), of which just 10 were for commercial property (Chart 4). Despite the fall in demand from local buyers, demand from PRC buyers remained relatively stable, resulting in their accounting for half of the deals concluded in the quarter. Among sectors, industrial was among the most active, supported by purchases of en-bloc building. In contrast, investment into retail, one of the sectors hardest hit by the pandemic, remained muted.

Mr Tom Ko, Cushman & Wakefield’s Executive Director, Capital Markets in Hong Kong, said, “With demand for commercial property expected to remain weak in coming months, PRC buying activity should continue to serve as a stable pillar of demand even as many local and foreign buyers continue to take a wait-and-see approach. Nonetheless, based on current trends, both the number of transactions and investment volume in 2020 are expected to fall to a 10-year low.”