(7 October 2020 Hong Kong) Without doubt, 2020 has been one of the most challenging years in Hong Kong’s history. Being heavily impacted by the uncertainties resulting from political tensions and the healthcare crisis, Hong Kong’s commercial real estate market has continued to sail through a rough sea, according to the CBRE Hong Kong 2020 Q3 MarketView. Investment volume fell to an 11-year low but there are initial signs that activity from Mainland Chinese buyers is picking up. Also, office vacancy continues to climb and rents continue to fall.

(按此瀏覽中文版)

Review and Commentaries

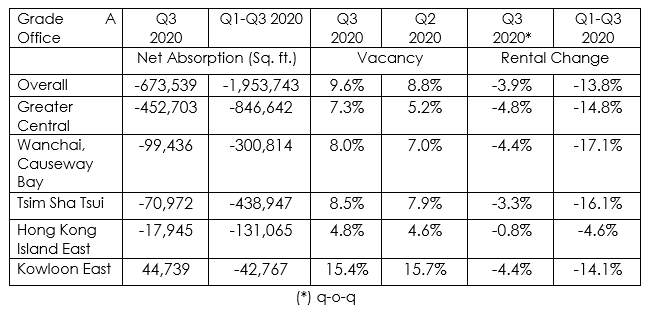

Grade A Office

- Office leasing momentum registered a slight improvement in Q3 2020. Gross leasing activity increased by 25% q-o-q but this nevertheless represented just half of the quarterly average over the past five years.

- The -673,500 sq. ft. of net absorption recorded this quarter pushed up overall vacancy by a further 0.8-ppt to 9.6%. Greater Central saw the largest increase in vacancy, reporting a rise of 2.1-ppt to 7.3%, while the core submarket’s net absorption recorded a historical record low of -452,700 sq. ft. Kowloon East was the only submarket to end the quarter with positive net absorption, which stood at circa 44,700 sq. ft.

- Overall rents fell by 3.9% q-o-q this quarter following declines of 7.0% q-o-q in Q2 2020 and 3.5% q-o-q in Q1 2020. Central recorded the sharpest decline among major submarkets, with rents falling by 4.8% q-o-q, bringing the y-t-d drop to 14.8%.

Alan Lok, Executive Director, Advisory & Transaction Services – Office Services, CBRE: “Q3 2020 saw office leasing momentum remain subdued despite a relative improvement from Q2. Corporates are still highly cautious about making real estate decisions and cost-saving continues to be their number one priority. Shadow space with fit-outs are welcomed by occupiers seeking to reduce CAPEX. In view of rising vacancy and shadow space, some landlords continued to soften their stance to retain tenants and even in some cases offer fit-out allowances to tenants in order to facilitate the leasing of their vacant spaces.”

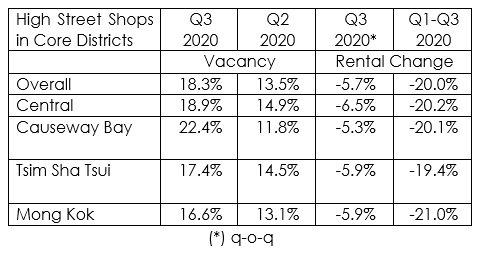

Retail

- Despite the city experiencing a third wave of COVID-19 cases for most of Q3 2020, the y-o-y decline in retail sales continued to decelerate. Total retail sales fell by 18.5% y-o-y in July and August combined, compared to a 31.4% y-o-y drop for Q2 2020. While this marked the fifth consecutive month of a softer y-o-y decline, this was partly due to the low base established during the widespread sociopolitical unrest in H2 2019.

- Several international fashion retailers continued to downsize, with at least 11 premises returned in Q3 2020. High-street shop vacancy in the four core districts climbed 4.8-ppt to reach 18.3% at end-September.

- The decline in high-street shop rents accelerated from 5.5% q-o-q in Q2 2020 to 5.7% q-o-q in Q3 2020. Shopping mall rents remained stable as landlords opted to support retailers via marketing and promotional measures.

Lawrence Wan, Senior Director, Advisory & Transaction Services – Retail, CBRE: “With many social-distancing measures remaining in place, retailers continued to adopt a cautious approach. Significant rental drops since last year, however, encouraged some local brands to explore leasing opportunities at low costs that had not existed for many years. Should the local pandemic remain contained, we expect to see a slight rebound in leasing activity in Q4.”

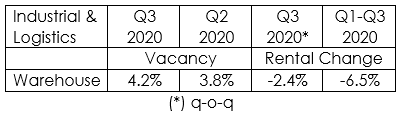

Industrial

- The city’s total merchandise trade fell by 3.6% y-o-y in July and August combined, an improvement on the 6.6% y-o-y decline registered in Q2 2020. Demand from western economies remained weak, with exports to North America and the EU falling by 17.8% and 20.9% respectively, compared to a drop of just 0.6% for Asia.

- Warehouse vacancy edged up 0.3-ppt to 4.2% at end-September as space was returned, primarily in ramp-access buildings. Leasing demand remained subdued aside from data centre and cold storage operators.

- Warehouse rents fell by 2.4% q-o-q in Q3 2020 after dropping by 3.0% q-o-q and 1.3% q-o-q in Q1 2020 and Q2 2020, respectively.

Samuel Lai, Senior Director, Advisory & Transaction Services – Industrial, CBRE: “Logistics operators continued to look for cost-saving options in Q3 2020. Ramp-access buildings have come under pressure as occupiers downsize and/or relocate to lower cost premises. Demand for data centre and cold storage facilities, however, remains strong as tech and telecom operators as well as food and online retailers expand. Given the low chance of a full containment of COVID-19 in most of the western economies in the foreseeable future, global trade demand is expected to remain soft in the months to come. Logistics operators will likely stay highly cautious in Q4. Warehouse vacancy will edge up further in Q4.”

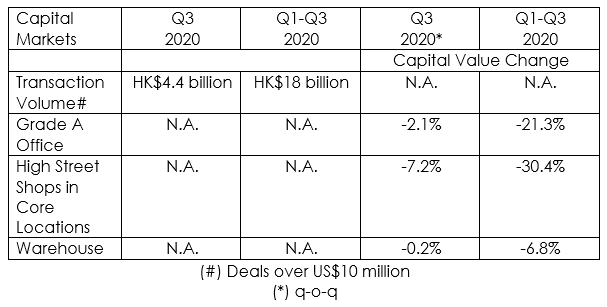

Capital Markets

- Despite the Hong Kong Monetary Authority (HKMA) raising the loan-to-value ratio cap for commercial property loans from 40% to 50%, commercial real estate investment volume in Q3 2020 fell to the lowest quarterly total since Q1 2009, with just HKD 4.4 billion worth of deals completed. This brought the y-t-d figure to HKD 18 billion, representing just 26% of the HKD 68.8 billion booked for full-year 2019.

- Developers continued to offload non-core retail properties. These included Wheelock and Chinachem, which sold shopping arcades for HKD 200 million and HKD 457 million respectively.

- Another market highlight included Hang Lung Properties winning the tender for a residential scheme in Shouson Hill for HKD2.6 billion, while the deal is not included as commercial real estate transactions.

- Mainland Chinese investors, who have been quiet for a few quarters, purchased HKD 2.2 billion-worth of assets in Q3 2020.

Reeves Yan, Executive Director, Capital Markets, CBRE: “The commercial property market remains very soft in term of transaction volume, despite the strong inflow of capital in recent months. Geopolitical and public health uncertainties will likely remain the major concerns for investors in Q4 and the chance of seeing a noticeable rebound in investment volume before the end of the year is low. However, the low cost of funding and the limited new supply across property sectors, backed by discounted prices, will ensure investors’ continued interest in Hong Kong investment opportunities. The strong IPO pipeline will also create a wealth effect and lead to a potential growth in corporate investment demand down the road.”

Visit www.cbre.com.